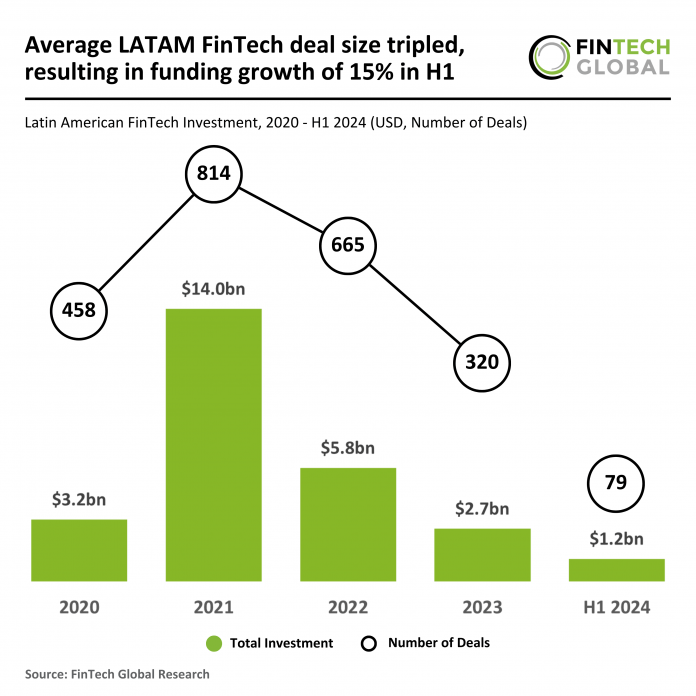

Key LATAM FinTech investment stats in H1 2024:

- LATAM FinTech funding increased by 15% YoY

- Average deal value rose by almost 3x as investors focused on higher value opportunities

- Celcoin secured the biggest deal for H1 2024 in LATAM with a $125m funding round

In H1 2024, the Latin American FinTech market saw mixed performance in terms of deal activity and funding. Only 79 deals were recorded in the first half of the year, marking a 58% decline compared to the 189 deals completed in H1 2023. However, despite the sharp drop in deal numbers, Latin American FinTech companies raised $1.17bn in H1 2024, a 15% increase over the $1.02bn raised in the same period the previous year. This suggests that although fewer deals were made, the investments were larger on average. However, H2 2023 was a notably stronger period for funding, with $1.7bn raised, indicating a trend of more robust investment activity in the latter half of the year.

The average deal value in H1 2024 was approximately $14.8m, a significant rise compared to $5.4m in H1 2023, reflecting a near 3x increase. This surge in average deal size suggests that even as deal activity slowed, investors are focusing on fewer but larger, higher-value opportunities, possibly targeting more mature FinTech companies or larger-scale projects in the region. This shift could reflect a growing focus on stability and profitability as Latin America’s FinTech sector continues to mature and attract significant funding despite economic challenges.

Celcoin, a leading company in the Banking as a Service (BaaS) financial technology market, secured the largest funding deal in Latin America for the first half of 2024 with a $125m investment led by global growth equity investor Summit Partners. Known for its investments in market-leading FinTech companies like EngageSmart and Corpay, Summit Partners was joined by existing investor Innova Capital and seasoned FinTech executive John Coughlin in this round. Founded in 2016, Celcoin provides financial infrastructure services for banks, FinTechs, and enterprises, focusing on payments, banking, and lending to enable personalized embedded finance solutions. With over 400 financial industry customers and more than 5,000 non-financial companies leveraging its offerings, Celcoin’s robust platform processes over 200m Pix transactions monthly. The new capital will support Celcoin’s expansion plans, further strengthening its leadership position in the BaaS and embedded finance markets, while driving continued innovation. The investment comes as Celcoin experiences strong momentum, recording $63m in annual recurring revenue in Q1 2024—a 140% increase year-over-year—alongside strategic acquisitions like Galax Pay, Flow Finance, Finansystech, and Reg+.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global