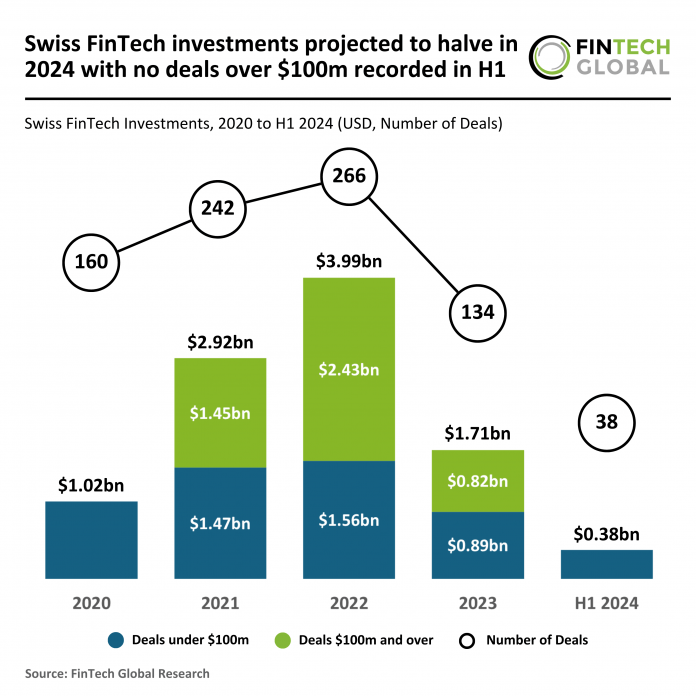

Key Swiss FinTech investment stats in H1 2024:

- Zero deals of $100m or over were recorded in H1, resulting in a 60% drop in funding YoY

- Trend analysis showed a potential halving in Swiss FinTech investments for 2024 based on investment from H1 2024

- Alpian, a digital banking platform, secured the largest FinTech deal in Switzerland UK during the first half of the year, with a Series C funding round of $84m

During the first six months of 2024, the Swiss FinTech sector experienced a sharp decline in both deal activity and overall funding compared to H1 2023. The first half of 2024 saw 38 deals completed, marking a 54% drop from the 83 deals recorded in H1 2023, and a 25% decline from the 51 deals in H2 2023. In terms of funding, the market saw a noteworthy decrease, with total funding falling to $381m, a 60% drop from $956m in H1 2023 and a 49% decline from $753m in H2 2023.

If this trend continues, the projected number of deals for 2024 is set to reach 76, a 43% decline from the 134 transactions completed in 2023. Funding for the year is on track to close at $762m, a dramatic 55% decline from the $1.7bn raised in 2023. This downturn suggests that the Swiss FinTech sector is facing a challenging environment, where fewer deals and lower funding levels are the result of reduced investor confidence and possibly greater market caution.

In H1 2024, all deals were under $100m, contributing the total $381m in funding. This marks a 23% drop from the $497m raised by deals under $100m in H1 2023 and a 3% decline from $393m in H2 2023. Notably, H1 2024 did not see any deals valued at $100m or over, reflecting a more conservative investment environment, possibly due to economic uncertainties and investor caution.

Alpian, Switzerland’s pioneering digital banking platform has closed its $84m Series C funding round, marking it the largest Swiss deals in the first half of the year. The investment, which includes $44m contingent upon regulatory approvals, highlights the growing confidence in Alpian’s innovative approach to digital wealth management and banking services. The new capital will fuel further advancements in Alpian’s financial solutions as the company continues its rapid expansion. In 2024, Alpian doubled its client base to several thousand in the first four months alone, with total assets nearing $111m, driven by its advisory mandate that bridges managed and self-directed solutions. This mandate, offering access to curated investment opportunities and personalised recommendations, complements the ‘Managed by’ discretionary mandate, contributing to a remarkable net performance of 14.28% in managed assets since inception. Additionally, Alpian’s competitive banking features, including some of Switzerland’s highest deposit interest rates and significantly lower forex exchange fees compared to traditional banks, continue to attract a growing client base.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global