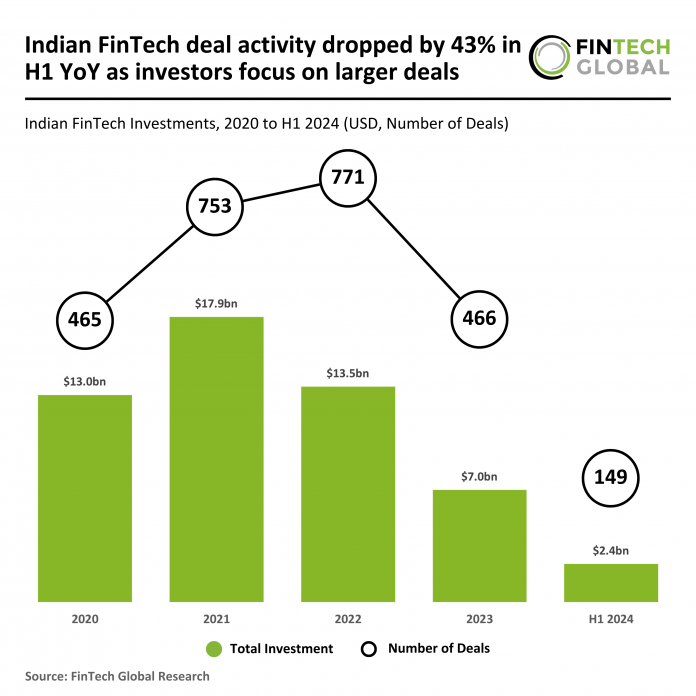

Key Indian FinTech investment stats in H1 2024:

- Indian FinTech deal activity decreased by 43% YoY

- Average deal size increased from $12.7m to $16m as investors focus on larger deals

- Svatantra, a technology driven microfinance company, secured the largest FinTech funding round in India with a $230m private equity investment deal

In H1 2024, the Indian FinTech sector saw a drop in both deal activity and funding. Only 149 deals were recorded in the first half of the year, representing a 43% decline compared to the 262 deals completed in H1 2023. Funding also saw a significant reduction, with FinTech companies raising just $2.38bn in H1 2024, a 29% drop from the $3.33bn raised in H1 2023. If this trend continues, the projected total for deal activity in 2024 would be around 298 deals, a 29% decrease from the 466 deals completed in 2023.

The average deal value in H1 2024 was $16m, reflecting an increase compared to the $12.7m in H1 2023. This increase in average deal value indicates that while the overall number of deals has significantly decreased, the investments being made are larger, suggesting a more selective approach by investors focusing on companies with greater growth potential or more established businesses within the FinTech sector.

Svatantra, a technology driven microfinance company secured the biggest deal in India for H1 with a $230m private equity investment deal. The company provides affordable financial and non-financial solutions to women entrepreneurs, it has emerged as one of the most differentiated process and technology-driven microfinance entities in India. Svatantra, along with its wholly owned subsidiary, Chaitanya, has a team of more than 17,000 employees and serves over 4.2m customers across 20+ states. Svatantra offers microcredit at affordable rates and has been a first mover and shaker of the industry by being the first MFI with 100% cashless disbursements since inception, and also the first to roll out an extensive customer-facing app that is conducive to client social behaviours.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global