Key US WealthTech investment stats in Q3 2024:

- US WealthTech funding increased by 42% in Q3 QoQ

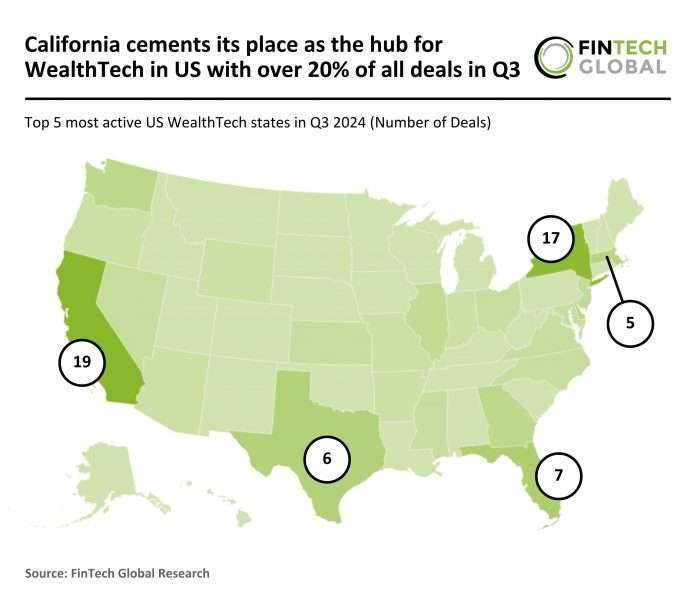

- By accounting for over 20% of all deals in Q3, California bolstered its status as the leading WealthTech hub in the country

- Savvy Wealth, a digital-first platform dedicated to modernizing financial advisory services, announced its arrival to the US WealthTech market with a Series A funding round of $26.5m

In Q3 2024, the US WealthTech market showed a slight recovery in both funding and deal activity compared to the previous quarter, although activity remained subdued compared to last year.

The sector recorded 94 funding rounds, down 80% from the 469 deals completed in Q3 2023. WealthTech companies in the US raised $1.86bn during Q3 2024, a steep 73% decrease from the $7.03bn raised in the same period last year.

This ongoing decline in deal volume and funding highlights persistent challenges within the WealthTech sector as investor interest remains below peak levels seen in 2023.

However, the quarter-over-quarter 42% increase in funding from $1.31bn in Q2 2024 to $1.86bn in Q3 2024 suggests some renewed confidence, potentially focused on a smaller number of high-value deals.

California remained the leading state in U.S. WealthTech deal activity, with companies there completing 19 deals (20% share) in Q3 2024, a significant decline of 86% from the 138 deals recorded in Q3 2023.

Despite this drop in deal count, California maintained a dominant position within the sector, emphasizing its continued influence.

New York followed with 17 deals (18% share), down from 67 deals in Q3 2023. Florida moved into the third spot with seven deals (8% share), replacing Texas, which was the third most active state in Q3 2023 with 38 deals.

This shift in rankings highlights how Florida has gained prominence in WealthTech deal activity, even as overall market activity has contracted significantly.

Savvy Wealth, a digital-first platform dedicated to modernizing financial advisory services, has marked its arrival with a $15.5m funding round led by Canvas Ventures, finalizing a $26.5m Series A round.

This latest capital boost will accelerate the advancement of Savvy’s AI-powered platform, expanding its product and engineering teams while attracting entrepreneurial advisors to its affiliate RIA, Savvy Advisors.

With robust support from Thrive Capital, Brewer Lane Ventures, Index Ventures, The House Fund, and Alumni Ventures, Savvy has raised over $33m since its 2021 launch.

The firm has rapidly built a national network, with 30 advisors managing $700m in client assets and poised to surpass $1bn AUM within the year.

By automating time-intensive back-office tasks through AI, Savvy enhances efficiency, allowing independent advisors to focus on delivering client value—positioning itself as an innovative force within wealth management.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global