Key Global CyberTech investment stats in Q3 2024:

- Global CyberTech funding dropped by 45% QoQ

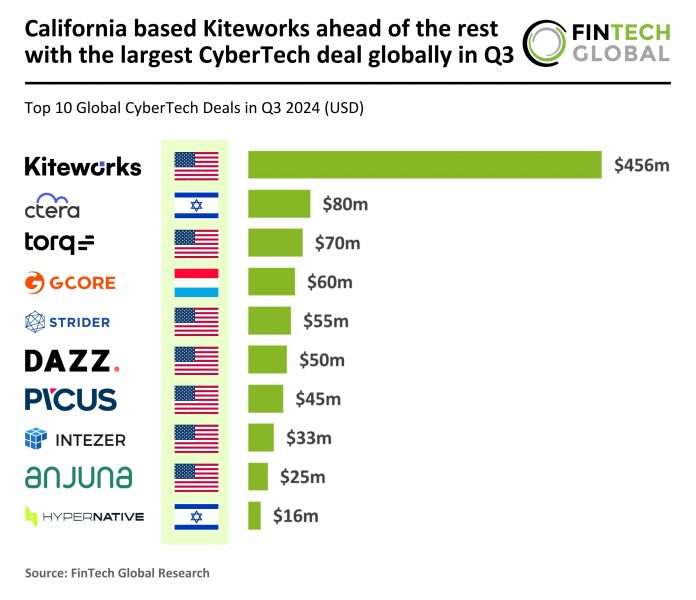

- US companies continued to dominate the CyberTech investment market as they secured 70% of the top 10 deals for the quarter

- California based Kiteworks, a secure content company specialising in protected data sharing across communication channels, was ahead of its counterparts as it secured the biggest CyberTech deal in Q3 with a $456m funding round

In Q3 2024, the global CyberTech sector recorded 71 transactions, marking a significant decline of 43% from the 124 deals completed in Q3 2023 and a 26% drop from the 96 transactions recorded in Q2 2024.

Total CyberTech funding for the third quarter reached $2.06bn, nearly unchanged from the $2.08bn raised in Q3 2023, despite the sharp decrease in deal volume.

This stable funding amid declining deal numbers suggests a shift toward larger investment sizes or a concentrated focus on fewer but more substantial investments within the CyberTech space.

The 45% funding drop from Q2 2024, which saw $3.74bn raised, reflects a continued cautious approach among investors, especially after the higher activity observed earlier in the year.

The top 10 deals in Q3 2024 were again dominated by the United States, securing seven of the top deals, consistent with its strong presence in Q3 2023.

Israel expanded its footprint, moving from one top deal in Q3 2023 to two in Q3 2024, underscoring its growing importance as a CyberTech hub.

Luxembourg emerged as a new entrant in Q3 2024’s top deals list, suggesting that European markets are progressively contributing to high-value CyberTech transactions.

Countries like Norway and Germany, which appeared in the top 10 deals for Q3 2023, were absent in Q3 2024.

Indicating a slight geographic shift in where larger deals are being made, with the U.S. and Israel continuing to lead, while smaller markets like Luxembourg signal a widening interest in robust cybersecurity investment across various regions.

Kiteworks, a secure content company specialising in protected data sharing across communication channels, secured the largest CyberTech deal of Q3 with a $456m growth equity round led by Insight Partners and Sixth Street.

The California-based firm described this as a “partial liquidity event,” allowing some investors to cash out, while still representing a minority investment that values Kiteworks at over $1bn.

Founded in 1999 and formerly known as Accellion, Kiteworks has now raised a total of $592m, following a prior $120m round in 2020 led by Bregal Sagemount.

This latest funding will support Kiteworks in advancing its secure data exchange platform, facilitating trusted communication for clients managing sensitive data.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global