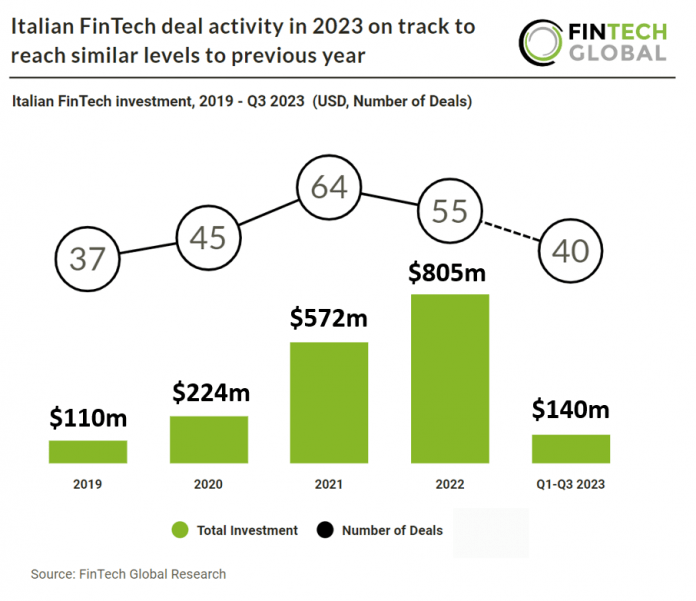

Key Italian FinTech investment stats in Q1-Q3 2023:

· Italian FinTech deal activity is projected to reach 54 deals in 2023, a 2% drop from 2022

· Italian FinTech companies are on track to raise $186m in 2023, a 77% drop YoY

· InsurTech was the most active FinTech subsector in Q3 2023 with two deals

Italian FinTech has seen mixed results in 2023 with deal activity on track to remain at similar levels to 2022 despite a major drop globally although investment has seen a major reduction. The forecast for Italian FinTech deal activity in 2023 anticipates a slight decrease, with an estimated 2% decline compared to the number of deals recorded in 2022, bringing the projected total to 54 deals. Overall there were just seven FinTech deals in Italy during Q3 2023 which may skew the projected total for 2023. Italian deal activity in Q3 2023 was 52% lower than the average over the previous two quarters. Italian FinTech firms are expected to secure $186m in funding during 2023, reflecting a significant YoY decrease of 77%.

Fabrick, an open finance company, had the largest Italian FinTech deal in Q1-Q3 2023 after raising $42.8m in their latest corporate round, led by Mastercard. Fabrick says the funding will go towards supporting its consolidation process in Italy, invest in products and services, scale up infrastructure, and expand into new European markets, following its recent acquisition of UK PayTech Judopay. Fabrick have extended their partnership with Mastercard, with whom they have been collaborating since 2019, to develop embedded finance solutions aimed at enhancing digitalization for businesses, financial institutions, and FinTechs throughout Europe. With operations in Italy, France, Spain, Portugal, and the UK, Fabrick employs over 400 people and reported a consolidated net revenue of €50 million in 2022, a 14% increase year-on-year, including its subsidiaries.

InsurTech was the most active FinTech subsector in Q3 2023 with two deals, a 29% share of deals. All other sectors only had one deal announced.