Consumer lending platform INSIKT has netted $50m in Series D funding, which was led by Grupo Coppel.

Existing investors First Mark Capital, Revolution Ventures and Colchis Capital took part in INSIKT’s funding.

The company utilises data and partnerships to make affordable credit available to the unbanked, who have a poor credit score. The solution allows brands to offer loans directly to their customers or allow people to invest in consumer loans.

Since 2014, the company has processed over 350,000 applications across a 620-store network. US-based INSIKT is currently in operation across California, Texas, and Illinois, while the company launched its services in Arizona last month.

This line of equity will be used by INSIKT to accelerate its growth into existing and new markets, with the company expecting to expand to more than 5,000 stores.

INSIKT co-founder and CEO James Gutierrez said, “Our mission is to help millions establish a good credit score, so they can buy a car, afford a new home, and make better financial decisions. Our white label model enables us to scale faster so we can reach millions and at lower cost by leveraging the power of existing stores, brands, and online channels.”

The capital injection puts the company’s total funding levels to $100m. Last month the company received an undisclosed strategic investment from LEAP Global Partners.

The company was co-founded by James Gutierrez and is his second creation, with him originally founding Oportun, which provides lending opportunities in standalone store fronts.

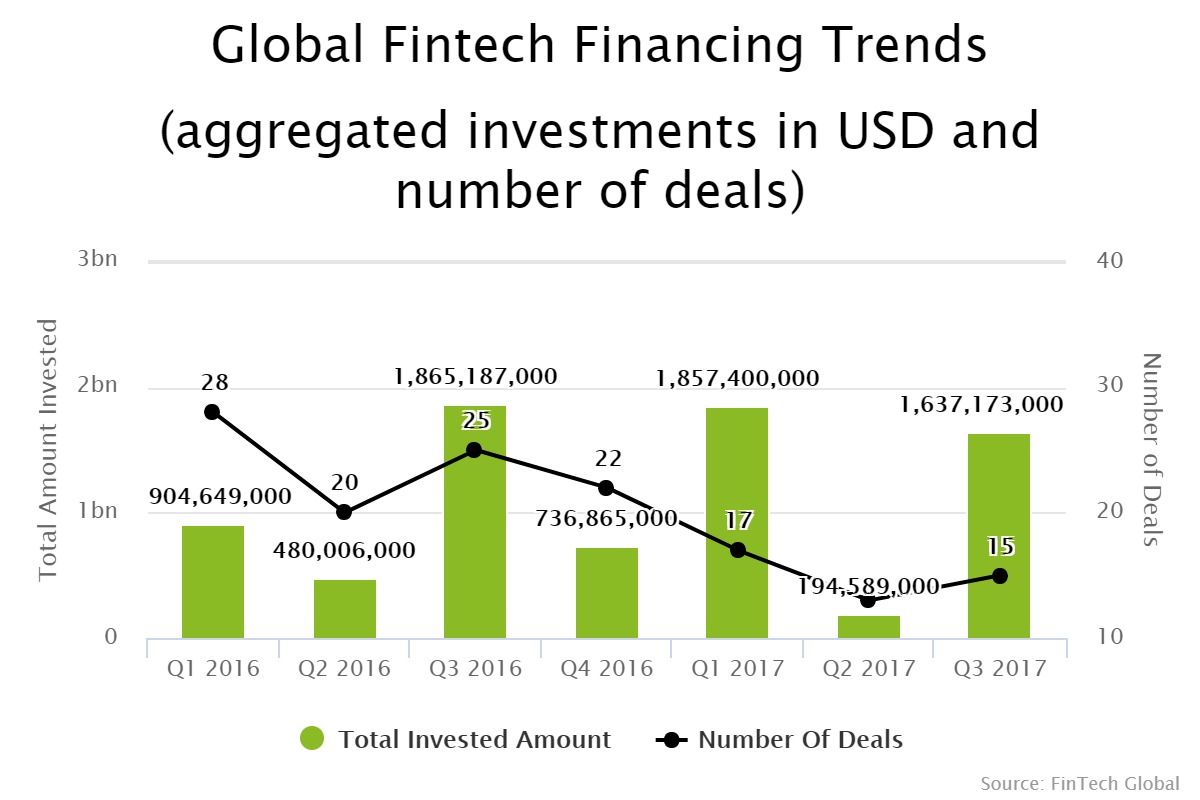

Despite a decline in deal levels, there has been an increase to the amount of capital deployed to North American marketplace lending companies. The first three quarters of 2017 has seen $439m more equity deployed, across 28 less transaction.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global