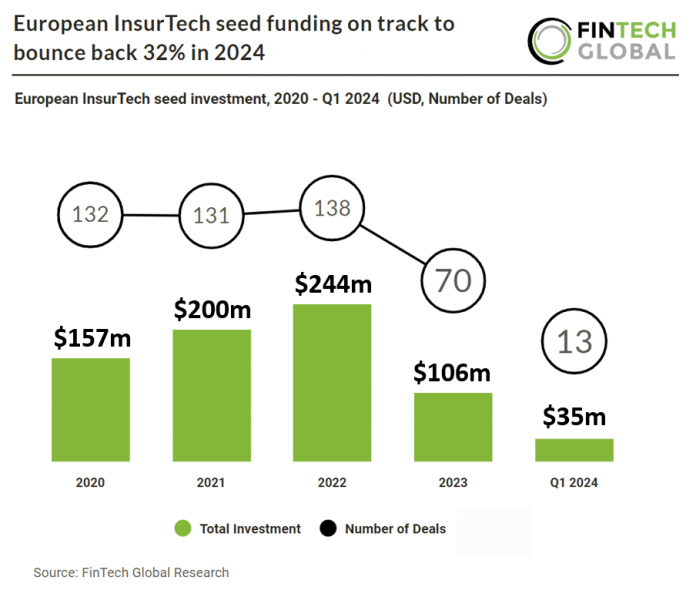

Key European InsurTech seed deal investment stats in Q1 2024

• European InsurTech seed deals reached 13 deals in Q1 which puts deal activity on track to reach 52 deals in 2024, a 26% decrease from 2023

• European InsurTech seed investment totalled at $35m and is on track to reach $140m based on Q1 funding activity, a 32% increase from the previous year

• Germany was the most active InsurTech seed country with four deals, a 31% share of total deals

In the first quarter, the European InsurTech sector saw a total of 13 seed deals, indicating a projected 52 transactions by the end of 2024, marking a 26% decrease from the previous year’s activity. However, InsurTech seed investments in Europe amounted to $35m in Q1, putting potential investment to reach $140m for the year, setting it on track for a 32% increase from the previous year’s figures.

CarbonPool, which provides carbon credit insurance with claims payments made in-kind, had the largest InsurTech seed deal in Q1 2024, after raising $12.2m in their seed round, led by Heartcore Capital and Vorwerk Ventures. Founded in 2023 by former Allianz executives Coenraad Vrolijk, Nandini Wilcke, and Frederic Olbert, CarbonPool is dedicated to expediting investment in carbon credits through the provision of carbon credit insurance, with claims settlements made in-kind. This innovative insurance model addresses potential setbacks such as shortfalls, reversals, business interruptions, and natural catastrophes that could impede the fulfillment of net-zero commitments, either by diminishing contracted carbon dioxide removal or inadvertently reintroducing carbon dioxide into the atmosphere. Primarily targeting corporate investors, fund managers, and project managers, CarbonPool aims to mitigate risks associated with carbon investments and foster the transition towards achieving net-zero emissions.

Germany was the most active InsurTech seed country with four deals, a 31% share of total deals. The UK was the second most active country with three deals, a 23% share of deals and France and Estonia were joint third with two deals each.