Key Singaporean FinTech investment stats in H1 2024:

- Singaporean FinTech deal activity dropped by 46% in the first half of the year in comparison to H1 2023

- Average deal value dropped to $13.3m suggesting a more risk averse approach by investors

- GXS bank, a pioneering digital bank secured the largest deal of H1 2024 in Singapore by completing a $169.1m funding round

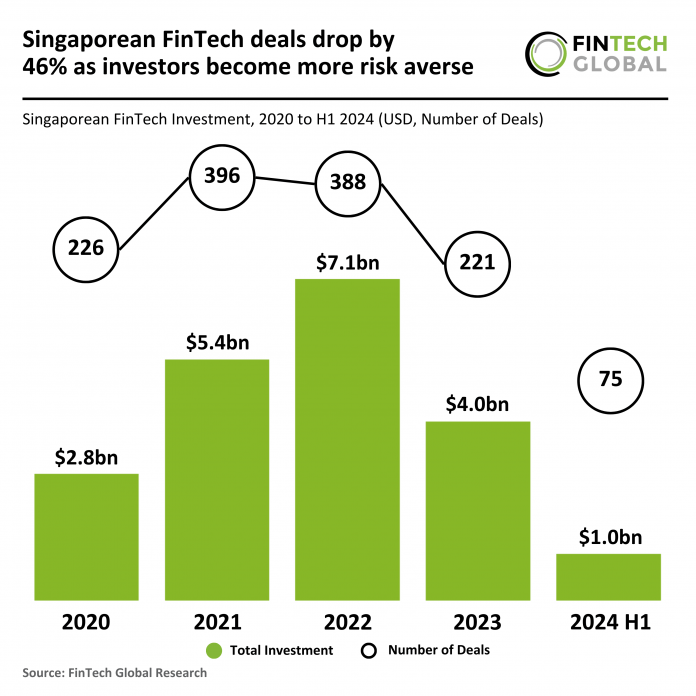

In H1 2024, the Singaporean FinTech sector experienced a drastic drop-in investment activity. Only 75 deals were completed in the country during the first half of the year, a 46% decline in comparison to the same period last year where 138 deals were completed. Funding saw a steeper drop, with FinTech companies raising just $1.0bn in H1 2024, a 50% decrease from the $2.0bn raised in H1 2023. If a similar trend were to continue for deal activity, the projected total for 2024 would be 150 deals only, a notable 32% reduction from last year’s total of 221.

The average deal value followed a similar trend, with the average deal value in H1 being approximately $13.3m, reflecting a decrease compared to the $14.5m in H1 last year. This decline in average deal value indicates that not only has the number of deals decreased, but the size of the investments has also shrunk, which could be for a number of reasons. One of the realistic possibilities could be due to widespread risk aversion and uncertainty due to global conditions like wars and elections in key regions.

GXS Bank, Singapore’s pioneering digital bank has secured the biggest deal in the region with a $169.1m capital injection from backers Singtel and Grab, according to regulatory filings with the Accounting and Corporate Regulatory Authority of Singapore. Grab took up the majority of the 229.5m shares, being allotted 191.8m shares, while Singtel received 37.7m shares. The digital bank has disbursed more than 100,000 loans in the first year of its FlexiLoan product, which targets gig workers and traditionally underserved bank customers. GXS Bank has also seen traction with FlexiLoan among segments well-served by traditional banks. Deposits in both GXS and Malaysia GXBank rose to $479m at the end of Q1 2023 from $36m in Q1 2022, driven mainly by GXBank, with over 90% of its depositors being Grab users. This funding will further support GXS Bank’s mission to deliver innovative financial solutions and expand its services.