Bank transfer solution company Dwolla has closed a $12m funding round led by Foundry Group.

Other participants to the round included Union Square Ventures, Next Level Ventures, Ludlow Ventures, High Alpha, and Firebrand.

US-based Dwolla provides developers and organisations with bank transfer networks, helping to connect third-party applications with US banking infrastructure. The company supports real-time payments, bank transfers and tokenisation solutions.

The technology, which has KYC checks and bank account verification, offers customer and transaction management. Clients using the technology can receive a facilitator fee for all transactions, and integrate ACH transfers, wire transfers, mass payments, wallet-like functions and pre-approved payments on their app.

Capital from the round will be used to meet its growing demands, as well as expanding its team, according to the company’s CEO.

Earlier in the year, Yahoo’s new social savings app Tanda picked the Dwolla solution to power its identity verification and money transfers. Last year, Dwolla netted a $6.85m round of funding co-led by Union Square Ventures and Foundry Group. The company raised the capital the relaunch of its white-label API.

Union Square Ventures led the $37.85m Series C funding in to personal finance solution Stash earlier in the week. The company provides consumers with a single platform to save, spend and build an investment portfolio.

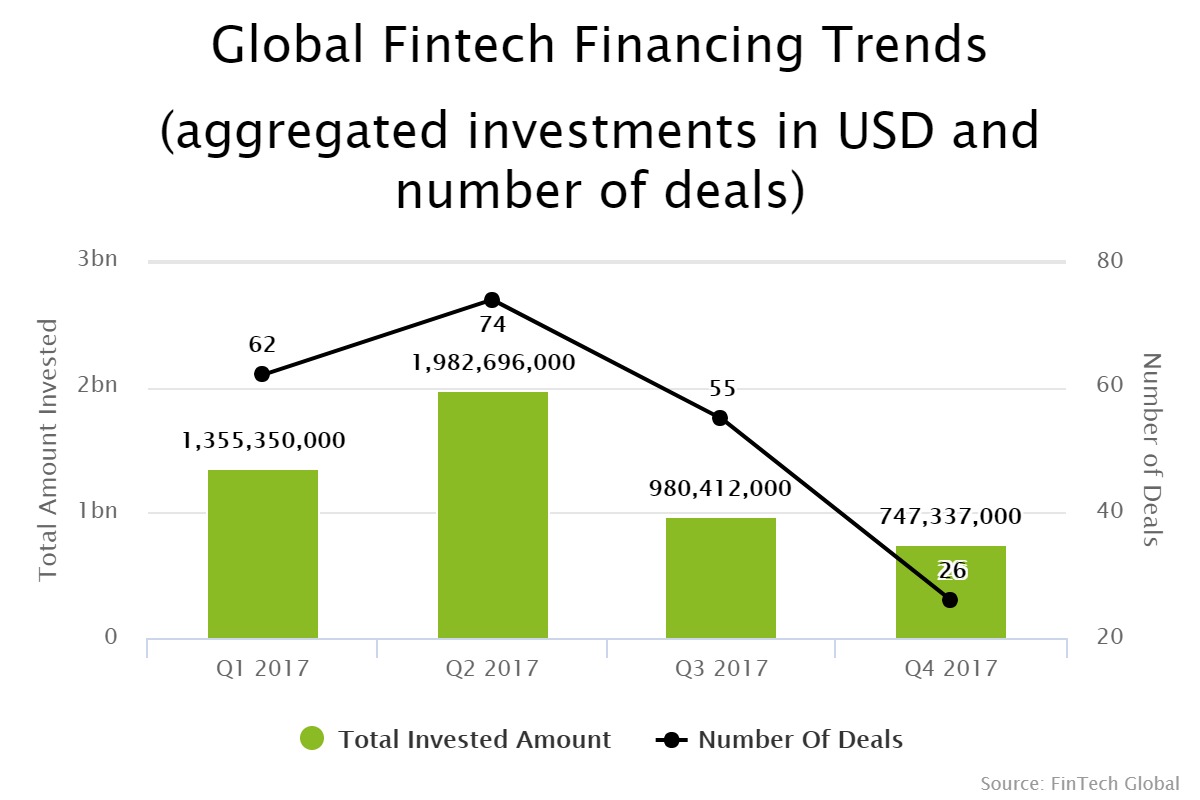

The global infrastructure and enterprise software sector has seen a two-quarter decline in funding, having dropped from $1.9bn in Q2 2017 down to $747m in the last quarter. This fall in capital has been matched by a decline in deal volume.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global