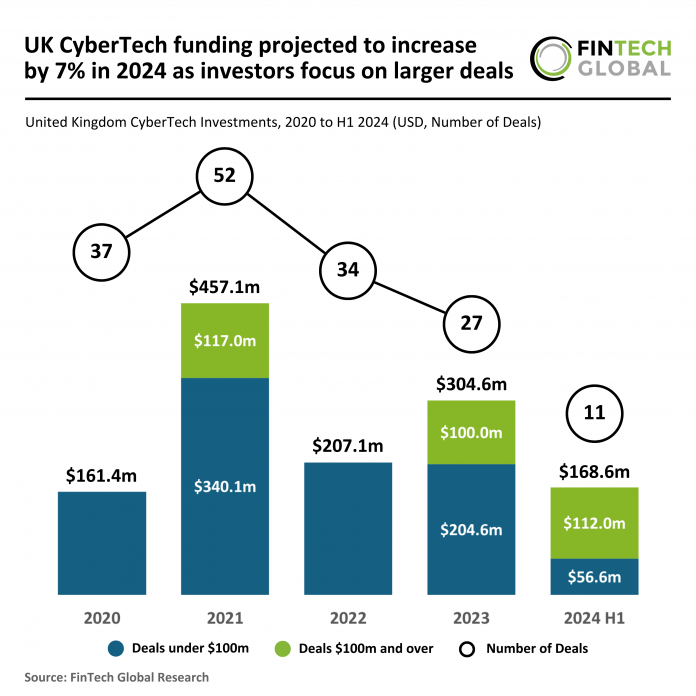

Key UK CyberTech investment stats in H1 2024:

- UK CyberTech funding increased by 5% in H1 2024 YoY

- Trend analysis showed a projected 7% increase in funding for the year as investors focus on deals of $100m and over

- PortSwigger secured the largest CyberTech deal in UK for the first half of the year with a $112m investment round

In H1 2024, the UK CyberTech sector saw a decline in deal activity but a slight increase in funding compared to the same period in 2023. A total of 11 deals were recorded in H1 2024, marking a 15.4% drop from the 13 deals completed in H1 2023, and a 21.4% decline from 14 deals in H2 2023. Despite fewer deals, total funding rose to $168.6m in the first six months of 2024, a modest 5% increase from $160.6m in H1 2023, and a notable 17% rise from $144m in H2 2023.

If this trend continues, the projected number of deals for 2024 could be around 48, a 26% decline from the 65 deals completed in 2023. In terms of funding, the year is projected to close with $675m, a 7% increase from the $632m raised in 2023. This shows that while deal activity has slowed, funding remains relatively stable as investors focus on high-value opportunities.

In the first six months of 2024, deals under $100m amounted to $56.6m, a sharp 64.7% drop from $160.6m in H1 2023. However, larger deals rose to $112m in H1 2024, up 12% from $100m in H2 2023. The average deal value in H1 2024 was $15.3m, up from $12.4m in H1 2023 and $10.3m in H2 2023, reflecting a shift towards fewer but larger transactions. This trend highlights a more selective investment environment, with capital increasingly concentrated on established players and high-growth CyberTech ventures.

PortSwigger, a renowned leader in cybersecurity specializing in web application and API security tools, secured the largest CyberTech funding round in UK for the H1 2024 with a $112m investment led by Brighton Park Capital. Founded in 2008 by Dafydd Stuttard, the company is best known for its flagship products, Burp Suite Professional and Burp Suite Enterprise, which serve nearly 20,000 global customers, including Microsoft and Salesforce. This significant funding will accelerate PortSwigger’s product development, expand its research initiatives, and strengthen its global presence, further cementing its position as a key player in the cybersecurity landscape.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global