Key Global FinTech investment stats in Q3 2024:

- Global FinTech deal activity dropped by 57% YoY

- FinTech investments projected to halve in 2024 as investors grow cautious due to challenging economic conditions

- Fourcore Capital, a rising leader in AI-powered asset and wealth management, secured one of the biggest deals in Q3 with a $500m funding round

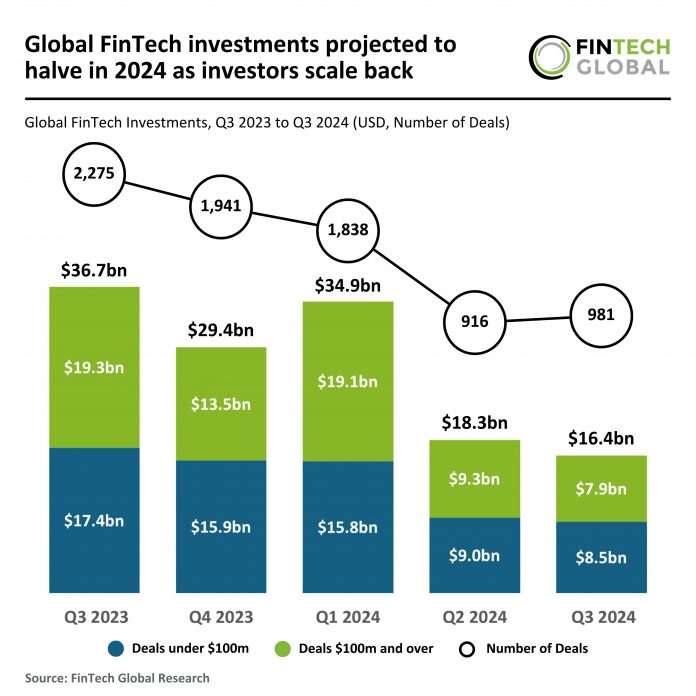

In the third quarter of 2024, the global FinTech sector saw a dramatic YoY drop in both deal activity and funding level.

Q3 2024 closed with 981 deals, a 57% drop from the 2,275 deals recorded in Q3 2023, though it marked a 7% increase over Q2 2024, which saw 916 deals.

Total funding in Q3 2024 amounted to $16.4bn, a substantial 55% decline from the $36.7bn recorded in Q3 2023, and a 10% decrease from the $18.3bn raised in Q2 2024.

If current trends continue, the projected deal count for 2024 is set to reach 3,794, marking a 49% decrease from the 7,393 transactions completed in 2023.

Meanwhile, total funding for the year is on track to close around $66.2bn, a noteworthy 53% decline from the $140.2bn raised in 2023.

This overall decline in both deal activity and funding underscores the challenging environment facing the global FinTech sector, where market caution and investor selectivity are resulting in fewer transactions and lower capital flow.

Funding from deals under $100m reached $8.5bn in Q3 2024, representing a 51% decrease from the $17.4bn raised by similarly sized deals in Q3 2023 and a slight 5% drop from the $9bn raised in Q2 2024.

In Q3 2024, larger deals valued at $100m or more accounted for $7.9bn, a 59% decline from the $19.3bn raised by such deals in Q3 2023 and a 15% decrease from the $9.3bn recorded in Q2 2024.

This downward trend in high-value deals further reflects a cautious approach among investors, likely influenced by broader economic uncertainties impacting the global financial landscape.

Fourcore Capital, a rising leader in AI-powered asset and wealth management, recently announced a landmark $500m share subscription facility with GEM Global Yield LLC SCS (GGY), making it one of the largest FinTech deals globally for the quarter.

This substantial investment will drive Fourcore’s strategic acquisitions, enhance AI and blockchain integrations across its platform, and expand its advisor support capabilities by appointing additional management talent.

With a commitment to growth and innovation, Fourcore is focused on delivering tailored solutions that combine advanced technology and disciplined investment strategies, positioning itself as a transformative player in the wealth management landscape as it prepares for a public listing.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global