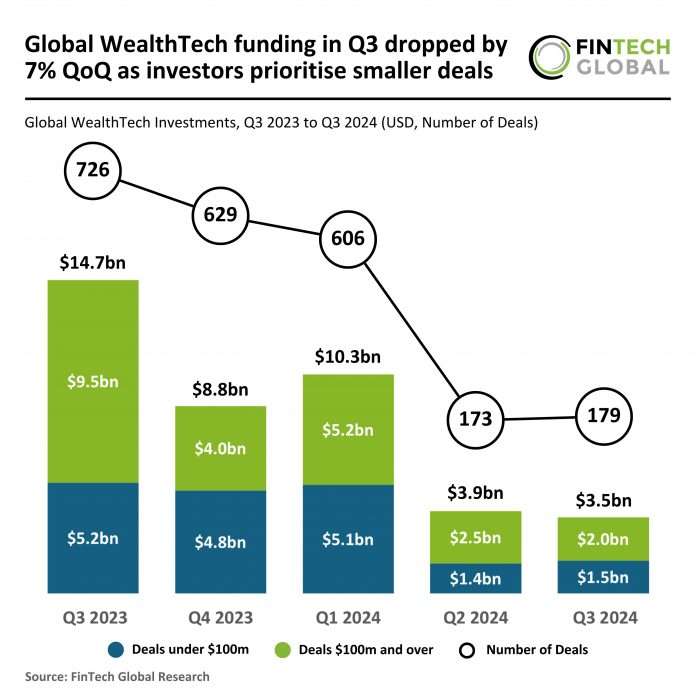

Key Global WealthTech investment stats in Q3 2024:

- Global WealthTech funding dropped by 7% QoQ during the third quarter

- Deals under $100m increased by 10% QoQ as investors focused on smaller deals

- DMI Finance, a pioneering digital financial services provider in India, secured one of the biggest WealthTech deals in Q3 with a $333m funding round

In the third quarter of 2024, the global WealthTech market continued to experience a steep decline in both deal volume and funding levels compared to the previous year.

Q3 2024 closed with 179 deals, a sharp 75% decrease from the 726 deals recorded in Q3 2023, though it showed a modest 3% increase over Q2 2024, which saw 173 deals.

Total funding in Q3 2024 amounted to $3.6bn, marking a 76% drop from the $14.7bn raised in Q3 2023, and a slight 7% decrease from the $3.9bn recorded in Q2 2024.

If this trend continues, the projected deal count for 2024 could reach approximately 704, indicating a 66% decline from the 2,081 deals completed in 2023.

Meanwhile, total funding for the year is on track to close at around $14.6bn, a substantial 67% decrease from the $44.4bn raised in 2023.

This consistent decline in both deal activity and funding underscores the cautious sentiment in the WealthTech sector, as global economic factors continue to shape a more selective and risk-averse investment landscape.

Funding from deals under $100m reached $1.5bn in Q3 2024, reflecting a 70% drop from the $5.2bn raised by similar-sized deals in Q3 2023, though it represents a slight 10% increase from the $1.4bn raised in Q2 2024.

In Q3 2024, larger deals of $100m or more contributed $2bn, a sharp 79% decline from the $9.5bn raised by such deals in Q3 2023, and a 17% drop from the $2.5bn recorded in Q2 2024.

This downward trend in both high- and low-value deals reflects a cautious stance among investors, who appear to be focusing on fewer, more resilient WealthTech opportunities in the current economic climate.

DMI Finance, a pioneering digital financial services provider in India, has secured an additional $333m investment from MUFG Bank, a subsidiary of Mitsubishi UFJ Financial Group, marking one of the largest WealthTech deals globally this quarter.

DMI’s innovative platform leverages advanced technology to deliver consumer finance through POS and cross-sell loans, reaching over 15.2m customers across India via strategic partnerships.

With MUFG’s support, DMI has scaled its business, established a robust track record in consumer finance, and advanced collaborative efforts, including business synergies with MUFG’s ecosystem companies under the MUFG Openly-connected Digital Ecosystem (MODE) initiative.

This investment further strengthens DMI’s position in the digital lending landscape, accelerates its growth trajectory, and enhances its role in advancing financial inclusion within the region.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global