Germany-based Vantik, a retirement planning platform for millennials, has closed its pre-seed round on €800,000.

The investment was led by Atlantic Labs and Seedcamp, with participation also coming from a selection of angel investors including N26 co-founder Maximilian Tayenthal.

Vantik enables consumers to build a customised private pension, focusing on supporting young people, young professionals and freelancers. The platform is fully adjustable to allow users to change their savings rate at any time or gain access to the money whenever they need it.

The company uses a ‘security buffer’ to ensure that all users receive a minimum of the amount they deposited on the app. The P2P buffer is formed through the 3 per cent target return generated by the platform, and is then invested into a separate vehicle.

Consumers increase their money while it is on the app due to Vantik opening a savings account with its partner bank DAB BNO Paribas. The money in the account is then automatically invested into an internationally diverse fund which then make returns for the account. The Vantik Fund backs ETFs such as shares, bonds, real estate, commodities and liquidity.

Seedcamp partner, Sia Houchangnia said, “We’ve been looking for innovations around the way Europeans save for retirement for a while and with Til and Lara, we believe we found the perfect team to go after this huge untapped opportunity. By offering a flexible and reliable digital, private pension, Vantik perfectly fits the needs of millennials and the way the future of work is shaping up.”

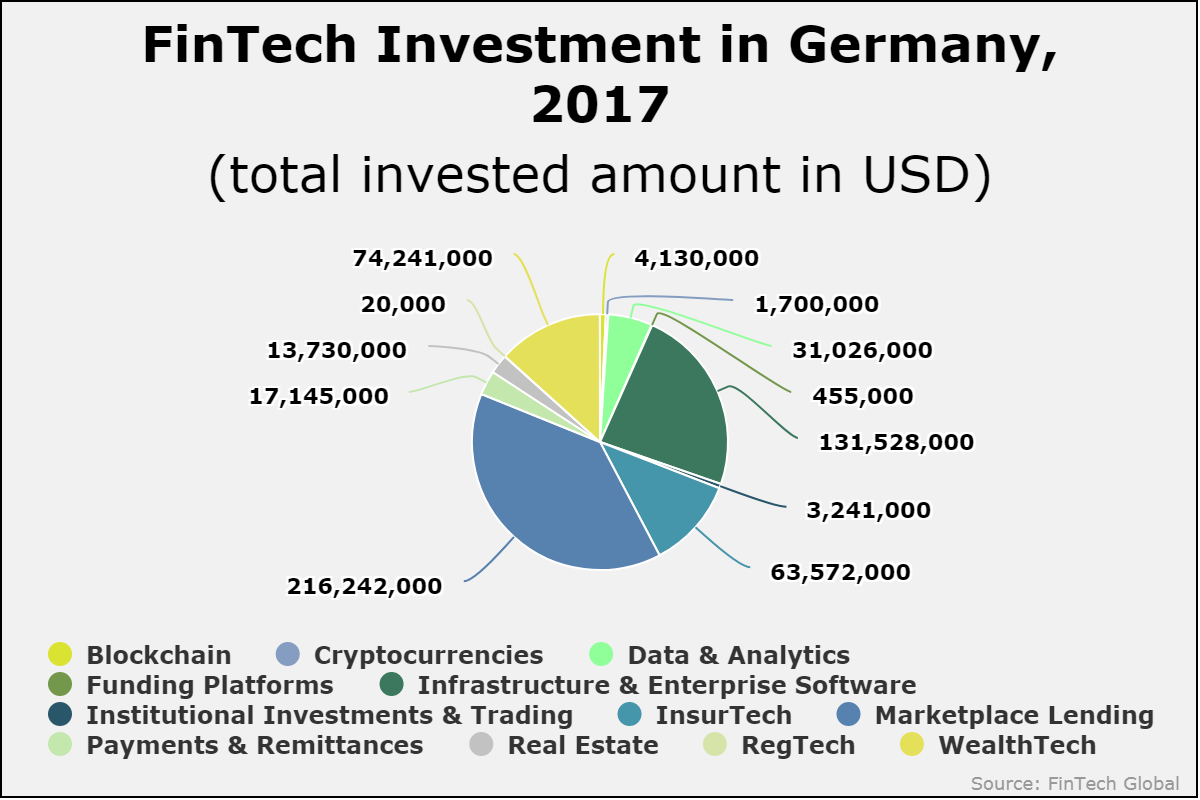

Last year, the lion share of funding to Germany’s FinTech sector went to the marketplace lending space, according to data by FinTech Global. The sector received 39 per cent of the total $553m that was invested in the country, this is compared to WealthTech, which received 14 per cent of funding.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global