Australia-based Athena Homes has reportedly received $15m in its Series A funding round.

The round was backed by Macquarie Bank, Square Peg Capital, Apex Capital and Rice Warner, according to a report by Business Insider Australia. Prior to this investment, Athena raised a $3m round last year.

Athena Homes is an online home loan company that aims to help customers get financing quicker and pay it off faster. Founded in 2017, the company uses technology to enable origination and investing through simpler and more transparent funding structures.

The platform works by partnering with ‘super funds’ to back home loans, the article states. Its beta pilot is set to launch next month.

Late last year, Square Peg Capital made a $6m investment into international payments company Airwallex, as part of a new partnership.

Earlier in the year, Australian mortgage comparison company Home Loans closed a $25m investment from Westpac, bringing its total investment into Home Loans to $51.5m. The company raised the equity to support the product innovation, and scaling of the business.

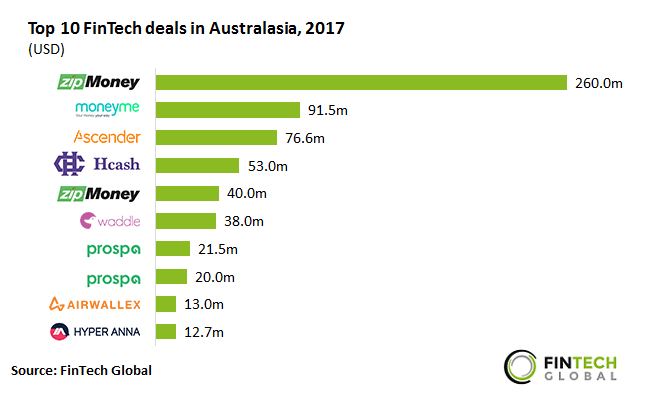

FinTech investments has increased six-fold in Australasia since 2014, according to data by FinTech Global. Last year, $750m was deployed across 56 deals, compared to $129m invested through 32 transactions in 2014.

The biggest FinTech deal to close in the region last year was digital credit card provider zipMoney Payments, which bagged $260m.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global