Value of German FinTech Investment in the first three quarters of 2018 hits a new funding record

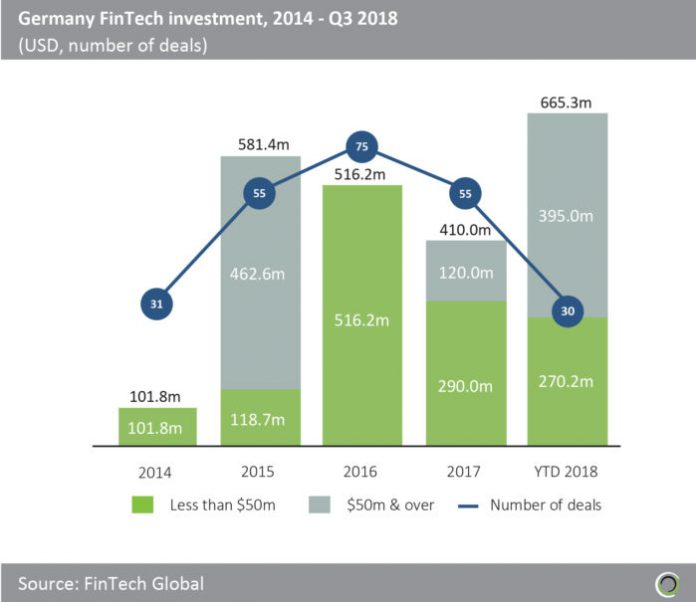

- This year the value of FinTech Investments in Germany has reached $665.3m across 30 deals. Capital raised in the first three quarters of the year is 62.3% higher than 2017’s total.

- More than half of the value invested in 2018 is made up of deals over $50m. There have been four of these funding rounds this year compared to just one in 2017. The biggest deal in 2018 was $160m raised by N26, a challenger bank, in a Series C round. In October this year, N26, which is backed by Tencent, launched in the UK with 50,000 people on the waiting list for its accounts.

- The second largest was $100m raised by Deposit Solutions in a private equity round. The investors who took part in this deal included Vitruvian Partners, e.ventures, Kinnevik AB and Greycroft. The company aims to make Open Banking the new standard and its platform provides an infrastructure for the deposit market.

- Deal activity, however looks set to decrease from the previous year. Deal numbers peaked in 2016 and have decreased in the two years since then. Currently, the number of deals this year is 40% of 2016’s level.

German FinTech investment in Q3 2018 is almost four times higher than the same quarter last year

- There was nearly four-times more capital invested in the last quarter than in Q3 2017. This can be attributed to the previously mentioned $100m Deposit Solutions deal, which makes up 52.3% of the total amount invested in Q3 2018. However, even without this deal investment in the last quarter is almost double compared to the same quarter last year.

- Last quarter there were nine deals altogether. The second largest funding round was a $38.6m series C raised by LIQID. The company provides customers with bank-independent, professional asset management, offering an alternative to traditional asset management.

- Deal activity in Q3 was the lowest of the three quarters so far this year, however, it was two deals higher than Q3 2017.

- Q1 2018 has seen the most investment this year. This investment includes the biggest deal of the year raised by N26. The second biggest deal was $70m raised by solarisBank AG in a Series B round. The company has built an API-accessible platform to provide companies with modular building blocks to innovate in finance.

FinTech Investment in Germany has shifted towards larger deals

- Deals above $20m as a proportion of overall deal activity have increased 25.5 percentage points (pp) from less than 10% last year to 34.6% in 2018.

- In the early stage segment of the market, the proportion of deals less than $1m in 2018 is just under a third of last year’s level.

- The share of these small deals has been markedly decreasing since 2014, when deals under $1m made up 61.54% of the proportion of total deal activity. There has been a mean decrease of 13.4 pp per year since 2014.

- This year so far 59.3% of deals have been above $10m. A testament to the maturing of the FinTech sector in Germany.

WealthTech companies have completed over a fifth of all FinTech deals since 2014

- Over 20% of all the 247 deals completed since the start of 2014 in Germany have been in the WealthTech subsector. The two largest deals in this subsector were, the previously mentioned N26 and Solaris Bank funding rounds.

- Marketplace Lending, the second largest subsector, makes up 17% of total deal activity. Three out of the four biggest deals in this subsector totalling $412.46m have been made by Kreditech. In fact, six funding rounds all raised by Kreditech in the last four years make up more than half of the total capital raised in the Marketplace Lending subsector. The company is aiming to provide access to better credit and a higher convenience for digital banking services.

- Infrastructure & Enterprise Software, Payments & Remittances and InsurTech have each attracted over 10% of deal activity; 15%, 15% and 13%, respectively.

- The smallest subsector RegTech makes up just 1% percent of total deal activity. This is at odds with other countries in Europe such as the United Kingdom and the Nordics which have a much higher proportion of deal activity in the RegTech sector. This is due to the German regulator, which is less flexible than some other countries in Europe.

- The other subsector includes companies that operate in Institutional Investments and Trading, Funding Platforms, Data & Analytics, Blockchain, and Cryptocurrencies.

Deal activity in the UK continues to be much higher than in Germany

- In the first three quarters of this year 82.9% of total deal activity across the two countries has been in the UK. This is only a 1.2 pp increase from last year showing a stable distribution of FinTech investments between the two countries.

- Since 2014 the UK has made up on average 78.4% of total deal activity each year.

- Eight of the top ten deals between these two countries have been in the UK. The other two which occurred in Germany were the previously mentioned N26 and Deposit Solutions deal.

- Also, the total amount invested in Germany in 2018 was just 23.6% of the total amount invested in the UK, showing that investors still have strong appetite for UK deals despite Brexit.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global