Following a rise in PropTech investments, American Patch Homes has closed a $5m funding round.

The startup was founded in 2016. Its partnership solution claims to empower homeowners to access up to $250,000 by tapping into their home equity without selling them or taking on additional debt.

Patch Homes’ Series A round was led by Union Square Ventures, the small collegial partnership that has previously supported micro-investment app developer Stash’s rounds in 2018 and 2019.

The round was also backed by venture capital firms Tribe Capital and Breega Capital.

“This funding will allow us to rapidly grow our team and continue our expansion, so that we can partner with even more homeowners,” said Sahil Gupta, co-founder of Patch Homes.

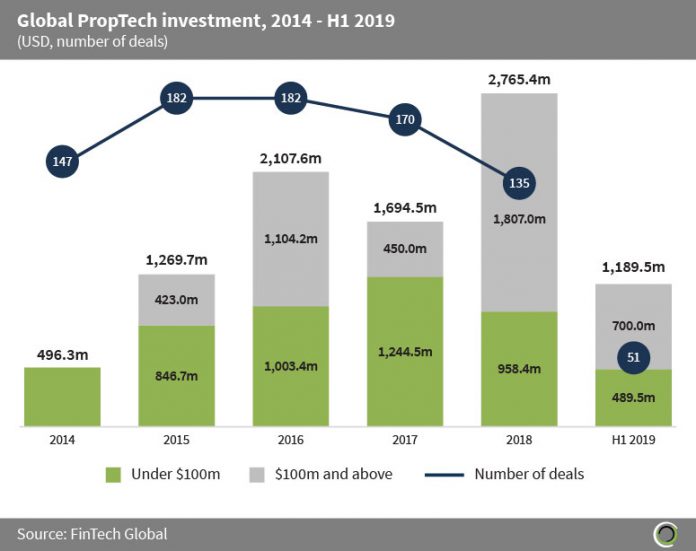

It is hardly the only PropTech company to have raised money over the past five years. Since 2014, the investment in the sector has jumped from $496.3m to $2.76bn in 2018, according to FinTech Global’s research.

Including the first six months of this year, the sector has attracted $9.5bn worth of investment since 2014. Part of this is due to a rise in real estate prices since the recession and a sector ripe for disruption.

Copyright © 2019 FinTech Global