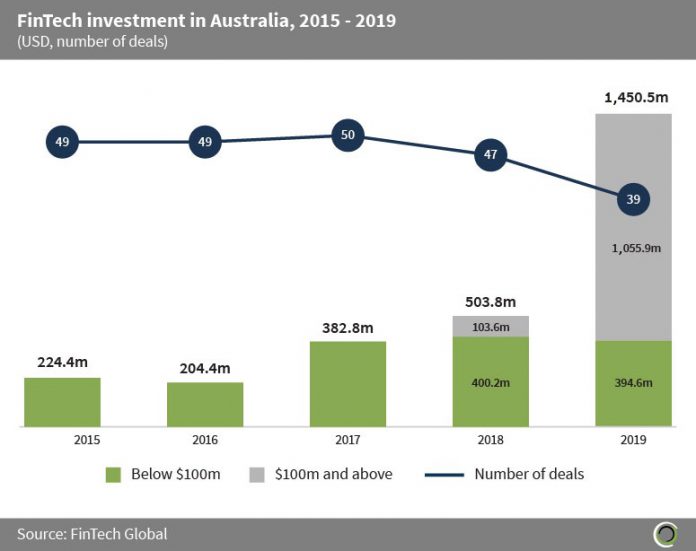

Over $1.4bn was raised by FinTech companies in the country in 2019

- FinTech companies in Australia have raised over $2.7bn across 234 deals between 2015 and 2019, with deals over $100m accounting for 41.9% of the capital raised during the period.

- Investment grew at a CAGR of 59.5% between 2015 and 2019 to $1,450.5m in 2019 across 38 deals. Average deal size increased over eight-fold from $4.6m in 2015 to $37.2m in 2019 as Australia’s FinTech landscape matures with investors rotating away from smaller deals towards later-stage transactions from more established firms.

- Funding raised in 2019 set a record with $1,450.5m invested across 39 deals. Of this capital 72.8% was invested in transactions valued at or above $100m. The amount invested in transactions valued below $100m have remained fairly constant since 2017 indicating the stability of the FinTech landscape in Australia as investors consistently invest in smaller deals in the region.

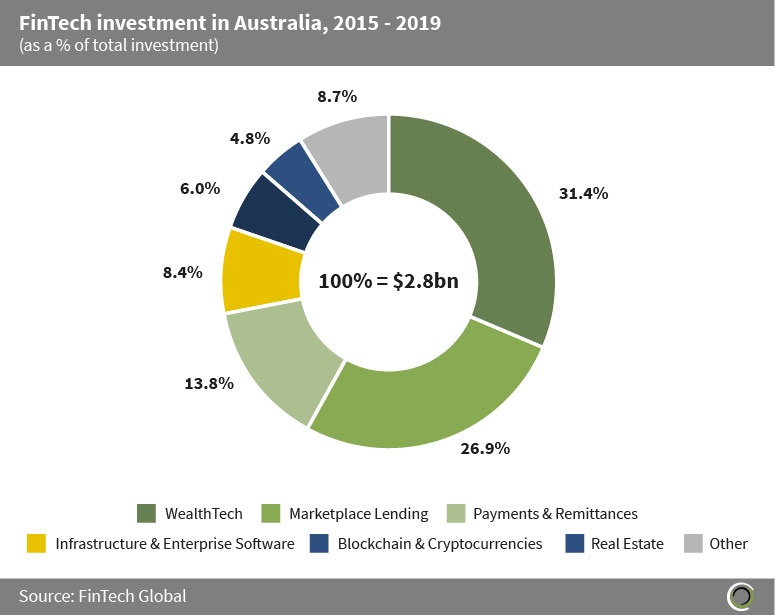

WealthTech and Marketplace Lending companies account for nearly 60% of FinTech funding in Australia since 2015

- In the Australian FinTech space there has been a concentration of capital investment in two main subsectors, WealthTech and Marketplace Lending, collectively capturing 58.3% of all investment in the region since 2015.

- WealthTech companies are responsible for 31.4% of capital raised by FinTech companies in Australia. This is to be expected due to Australia’s tech savvy millennial population looking to bypass legacy banking and turn to challenger banks for their financial needs.

- Marketplace Lending companies in the country account for 26.9% of investment in the country between 2015 and 2019. This comes as FinTechs in the lending space look to capitalise on the resulting scepticism still felt towards mainstream banks after the financial crash of 2008, and offer more competitive interest rates, improve borrower experiences and reach underserved markets. Australia offers an attractive investment opportunity in this space as lending solutions such as P2P lending which have been proven to be successful are already well established in the UK and US but remain in their infancy in Australia, allowing investors to capitalise early on in the growth of the space.

- The other category consists of companies in RegTech, Data & Analytics, InsurTech, Institutional Investments & Trading and Funding Platforms subsectors which collectively account for just 8.7% of investment in Australia since 2015.

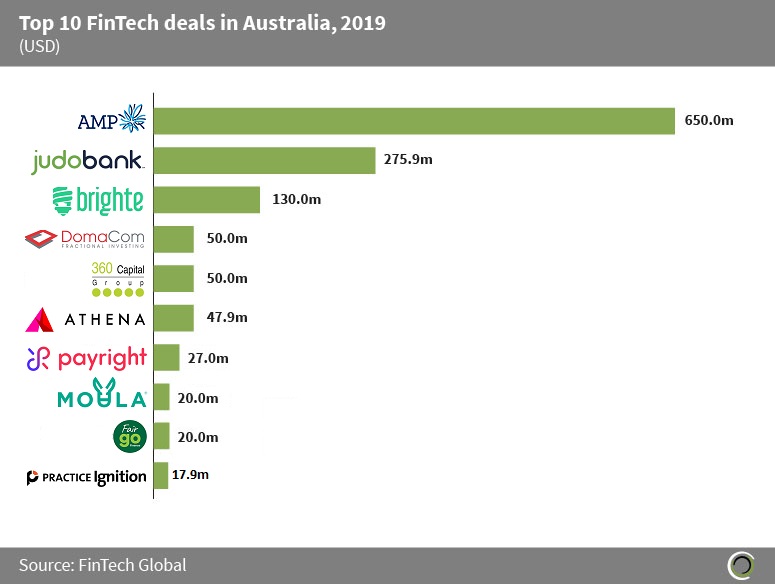

Over $1.3bn was raised in the top 10 FinTech transactions in Australia in 2019

- Over $1.3bn has been raised in the top 10 FinTech transactions in Australia last year, accounting for 47% of the total capital raised in the country during the period. Of the top 10 deals, one was raised in Q1 2019, one in Q2 2019, six in Q3 2019 and two in Q4 2019.

- The largest deal of 2019 was raised by AMP in Q3 2019. AMP offers wealth management solutions to customers in Australia and New Zealand. The company raised $650m in a Post-IPO-equity round in August 2019.

- The largest deal raised in Q4 2019 came from Athena Home Loans led by AustralianSuper. The company raised $47.9m in a Series C round and plans to use the capital to allow growth of the business into offering loans for property purchases, a substantially bigger market than it currently reaches.

- Capital allocation within the top 10 deals was widely distributed across subsectors with Infrastructure & Enterprise Software companies accounting for one deal, Payments & Remittances, Real Estate and WealthTech companies accounting for two deals each and Marketplace Lending companies making up the remaining three deals.

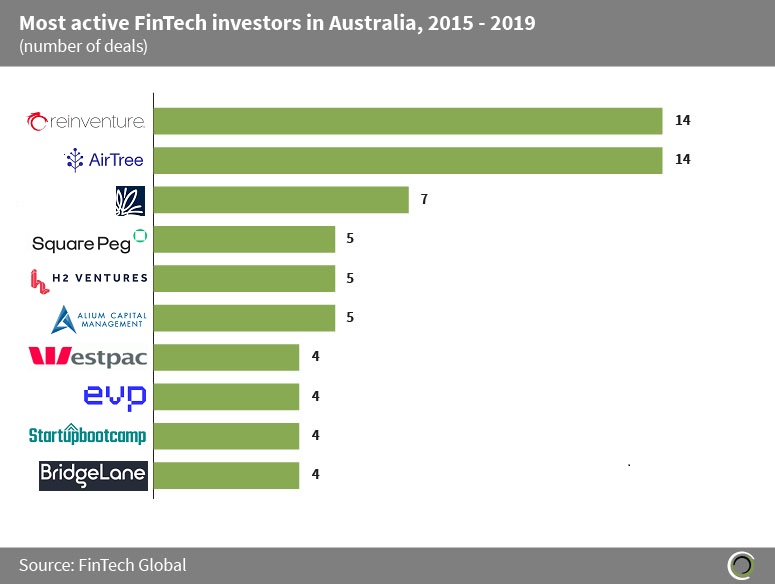

Reinventure and AirTree Ventures were the most active investors in Australia between 2015 and 2019

- Of the 234 FinTech transactions that were raised in Australia since 2015, the top FinTech investors in the country have been involved in 66 deals between them.

- Reinventure was one of the most active FinTech investors in Australia since 2015, participating in 14 deals between 2015 and 2019. The venture capital firm’s most recent investment in Australia was the $12.5m Series B funding raised by Valiant, a marketplace offering business and commercial financial services online.

- AirTree Ventures also participated in 14 FinTech deals in Australia between 2015 and 2019. The largest round the firm participated in was the aforementioned $47.9m Series C round raised by Athena Home Loans, a home loan platform which aims to offer better service, speed and savings to consumers. AirTree Ventures were joined on the round by Square Peg Capital, Salesforce Ventures, NAB Ventures, Hostplus and AustralianSuper, who led the round.

- Of the top 10 investors, seven are venture capital firms (Equity Venture Partners, Alium Capital, Square Peg Capital, AirTree Ventures, Reinventure, BridgeLane Capital and AMP New Ventures), with the other three being two accelerators (H2 Ventures and Startupbootcamp) and an investment bank (Westpac).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global