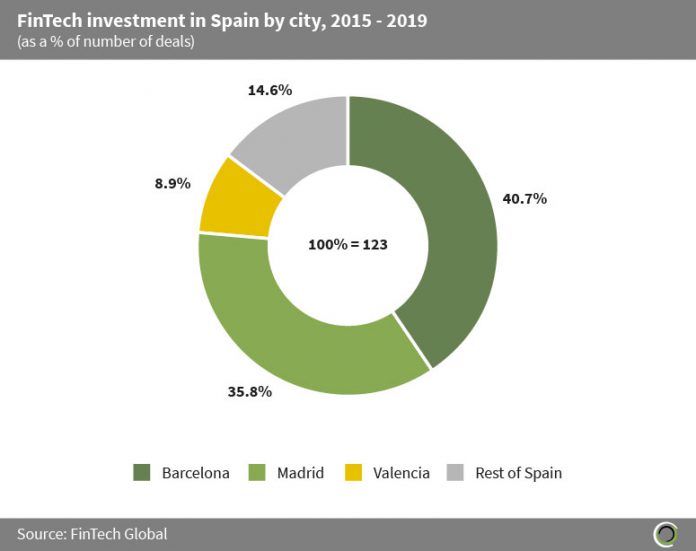

Spanish FinTech companies have completed 123 funding rounds between 2015 and 2019, with companies operating in Barcelona and Madrid receiving 76.5% of all deal activity in the country.

Companies in Barcelona captured the lion share of deal activity over the period with 40.7% of total transactions in the country taking place in the city. According to VC company Atomico State of European Tech report, Barcelona is ranked the ?fifth largest source of venture capital in Europe?, with venture capital companies setting up permanent offices in the Catalonia capital. Barcelona success in its FinTech sector comes from having strong access to software developers, tech talent, and its connectivity making it easy getting into the city from places like San Francisco, Tel Aviv, and other tech hubs in Europe.

The second most active Spanish city was Madrid accounting for 35.8% of FinTech activity in the country between 2015 and 2019. One of the leading FinTech startups in Madrid is Pagantis, a Spanish consumer lending company, which raised $73.1m in a series B round led by Prime Ventures, SPF Investment Management, and Rinkelberg Capital Group in March 2019 for their e-commerce financing platform.

The Rest of Spain category contains companies operating in other Spanish cities such as Marbella, Sevilla and others, which collectively have accounted for 14.6% of deal activity in the country since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ?2020 FinTech Global