India-based Razorpay has picked up another $100m in Series D funding round co-led by Sequoia India and GIC.

Sequia had previously backed Razorpay’s $75m Series C round in 2019.

While the exact figure of the new valuation is unknown, the FinTech startup told TechCrunch that the new cash injection puts it somewhere over $1bn.

Existing investor Ribbit Capital, Tiger Global, Y Combinator and Matrix Partners also chipped in with fresh capital in the Series D.

Payment processing company Razorpay was founded in 2014. As part of its offering it processes and disburses money online for small businesses as well as having recently launched a digital banking platform that has seen it issue corporate credit cards.

“Razorpay has established itself as a clear leader, with its strong focus on customer experience and product innovation,” said Choo Yong Cheen, chief investment officer for private equity at GIC, in a statement seen by TechCrunch. “GIC has a long track record of partnering with leading fintech companies globally and is delighted to partner with Razorpay in its journey to transform payments and banking.”

In August 2019, we reported that Bangalore-based Razorpay had acquired Thirdwatch, an enterprise using big data to prevent ex-commerce businesses becoming fraud victims. The acquisition would enable Razorpay to strengthen its core competencies in big data.

Razorpay is the latest FinTech company to add the coveted title of unicorn to its name in 2020. For instance, we have seen kid-focused money app Greenlight, Latin American cross-border payment platform dLocal, open source database Redis Labs and credit-trading company xTrumid Financial also achieve valuations north of the $1bn mark this year.

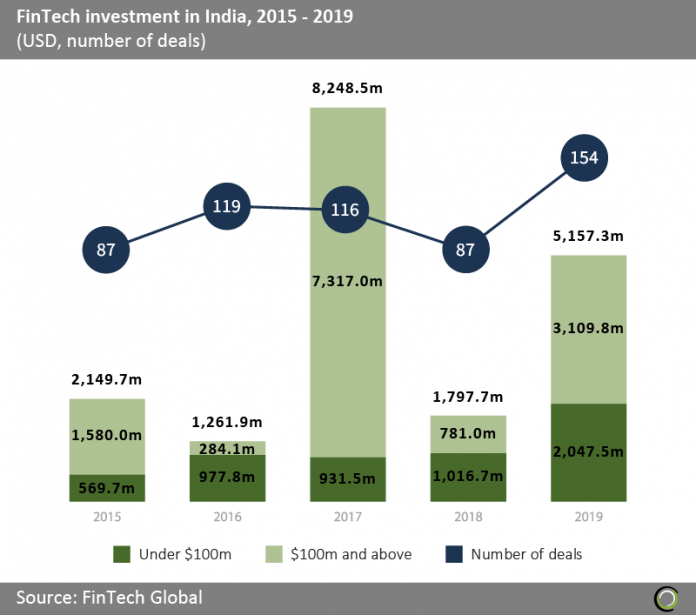

Looking at India in general, FinTech activity in nation has nearly doubled since 2015, in terms of investment. Back in 2015, the Indian FinTech sector raised $2.14bn, according to FinTech Global’s data. The investment into the sector then shot to the skies in 2017 when the industry convinced investors to back it to the tune of $8.24bn in investment.

Even though investment slumped in 2018 to only reach $1.79bn, the industry recovered in 2019 when 154 deals with a combined value of $5.15bn were completed.  Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global