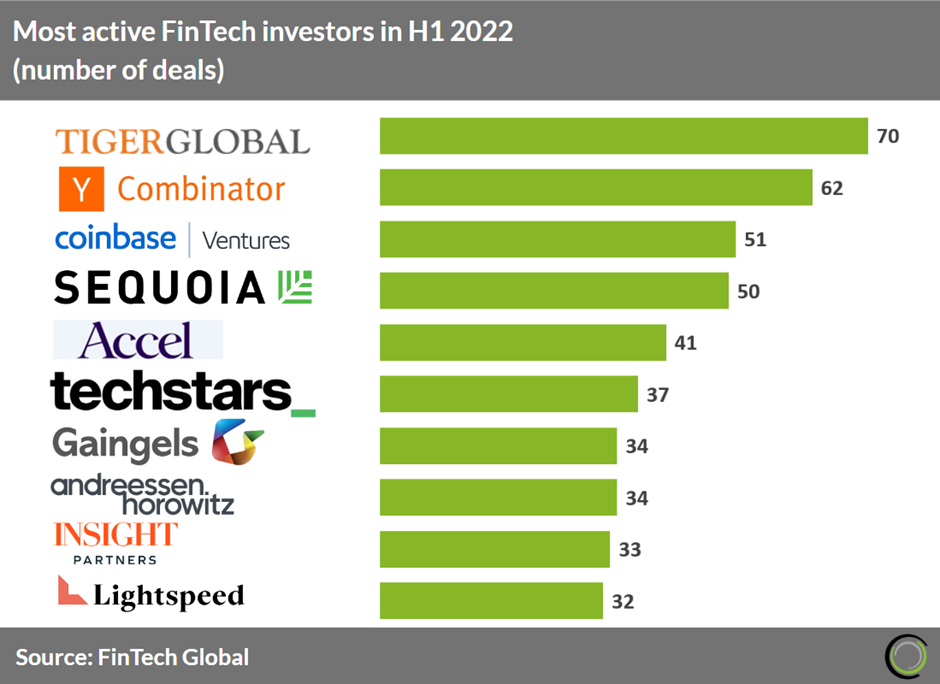

| Tiger Global Management | Early Stage Venture, Late Stage Venture, Post-Ipo, Private Equity, Secondary Market | New York, New York, United States | http://tigerglobal.com | Hedge Fund, Private Equity Firm, Venture Capital | 73 |

| Y Combinator | Debt, Early Stage Venture, Seed | Mountain View, California, United States | http://www.ycombinator.com | Accelerator | 62 |

| Global Founders Capital | Early Stage Venture, Late Stage Venture, Seed | Berlin, Berlin, Germany | https://www.globalfounderscapital.com | Venture Capital | 50 |

| Coinbase Ventures | Early Stage Venture | San Francisco, California, United States | https://ventures.coinbase.com | Corporate Venture Capital | 47 |

| Accel | Early Stage Venture, Late Stage Venture, Seed | Palo Alto, California, United States | http://www.accel.com | Venture Capital | 39 |

| Andreessen Horowitz | Early Stage Venture, Late Stage Venture | Menlo Park, California, United States | http://www.a16z.com | Venture Capital | 35 |

| Insight Partners | Debt, Early Stage Venture, Late Stage Venture, Private Equity, Seed | New York, New York, United States | http://www.insightpartners.com | Private Equity Firm, Venture Capital | 35 |

| Gaingels | Early Stage Venture, Late Stage Venture, Seed, Venture | Burlington, Vermont, United States | http://www.gaingels.com | Syndicate, Venture Capital | 34 |

| Lightspeed Venture Partners | Early Stage Venture, Late Stage Venture, Private Equity | Menlo Park, California, United States | http://lsvp.com | Venture Capital | 31 |

| Soma Capital | Early Stage Venture, Late Stage Venture, Seed, Venture | San Francisco, California, United States | http://www.somacap.com | Venture Capital | 27 |

| The Spartan Group | Early Stage Venture | Singapore, Central Region, Singapore | https://www.spartangroup.io | Venture Capital | 25 |

| Alumni Ventures | Convertible Note, Early Stage Venture, Initial Coin Offering, Late Stage Venture, Seed, Venture | Manchester, New Hampshire, United States | http://www.av.vc | Angel Group, Micro VC | 24 |

| Sequoia Capital | Early Stage Venture, Late Stage Venture | Menlo Park, California, United States | http://www.sequoiacap.com | Venture Capital | 24 |

| Shima Capital | Early Stage Venture, Seed | San Francisco, California, United States | https://shima.capital/ | Venture Capital | 23 |

| F10 | Early Stage Venture, Late Stage Venture, Seed | Zürich, Zurich, Switzerland | https://www.f10.global/ | Accelerator, Co-Working Space, Entrepreneurship Program, Incubator | 22 |

| Alameda Research | | Central and Western, Hong Kong Island, Hong Kong | https://www.alameda-research.com | Private Equity Firm | 22 |

| Speedinvest | Early Stage Venture, Seed, Venture | Vienna, Wien, Austria | http://speedinvest.com | Venture Capital | 22 |

| GSR | Early Stage Venture | London, England, United Kingdom | https://www.gsr.io | | 22 |

| Bessemer Venture Partners | Early Stage Venture, Late Stage Venture | Redwood City, California, United States | http://www.bvp.com | Venture Capital | 21 |

| Techstars | Debt, Early Stage Venture, Seed | Boulder, Colorado, United States | https://www.techstars.com | Accelerator, Venture Capital | 21 |

| Sequoia Capital India | Early Stage Venture, Late Stage Venture | Bengaluru, Karnataka, India | https://www.sequoiacap.com/india | Venture Capital | 20 |

| Antler | Early Stage Venture, Seed, Venture | Singapore, Central Region, Singapore | https://antler.co/ | Venture Capital | 20 |

| Bpifrance | Debt, Early Stage Venture, Grant, Private Equity, Seed | Maisons-alfort, Ile-de-France, France | http://bpifrance.fr | Government Office, Investment Bank | 20 |

| SoftBank Vision Fund | Late Stage Venture | London, England, United Kingdom | https://visionfund.com | Private Equity Firm, Venture Capital | 19 |

| Jump Crypto | | Chicago, Illinois, United States | https://jumpcrypto.com | | 19 |

| Pantera Capital | Early Stage Venture, Seed | Menlo Park, California, United States | http://panteracapital.com | Venture Capital | 18 |

| Jump Capital | Early Stage Venture, Late Stage Venture, Seed | Chicago, Illinois, United States | http://www.jumpcap.com | Venture Capital | 16 |

| Multicoin Capital | Early Stage Venture, Seed | Austin, Texas, United States | https://multicoin.capital | Hedge Fund, Venture Capital | 16 |

| General Catalyst | Early Stage Venture, Late Stage Venture, Seed | Cambridge, Massachusetts, United States | http://www.generalcatalyst.com | Venture Capital | 16 |

| QED Investors | Early Stage Venture, Late Stage Venture, Private Equity, Seed | Alexandria, Virginia, United States | http://www.qedinvestors.com | Venture Capital | 15 |

| SevenX Ventures | | | http://www.7xvc.com/ | Venture Capital | 15 |

| Picus Capital | Convertible Note, Debt, Early Stage Venture, Seed | Munich, Bayern, Germany | http://www.picuscap.com | Venture Capital, Venture Debt | 15 |

| Anthemis Group | Early Stage Venture, Late Stage Venture, Seed, Venture | London, England, United Kingdom | http://www.anthemis.com | Venture Capital | 15 |

| Eurazeo | | Paris, Ile-de-France, France | https://www.eurazeo.com/en/ | Private Equity Firm | 15 |

| A* Partners | | San Francisco, California, United States | https://www.a-star.co/ | Venture Capital | 15 |

| Digital Currency Group | Early Stage Venture, Initial Coin Offering, Late Stage Venture, Seed | Stamford, Connecticut, United States | http://dcg.co | Venture Capital | 14 |

| Better Capital | Early Stage Venture | Santa Clara, California, United States | https://www.bettercapital.vc | Venture Capital | 14 |

| FTX Ventures | | Nassau, New Providence, Bahamas | | Venture Capital | 14 |

| Solana Ventures | | | https://solana.ventures | Venture Capital | 14 |

| Index Ventures | Early Stage Venture, Late Stage Venture, Seed | San Francisco, California, United States | http://www.indexventures.com | Venture Capital | 14 |

| Hypersphere Ventures | | Miami, Florida, United States | https://hypersphere.ventures/ | Venture Capital | 14 |

| Circle Ventures | | New York, New York, United States | http://www.circleventures.com | Venture Capital | 14 |

| IOSG Ventures | Early Stage Venture, Private Equity, Seed, Venture | Grand Cayman, Midland, Cayman Islands | http://iosg.vc | Incubator, Private Equity Firm, Venture Capital | 14 |

| Seedcamp | Early Stage Venture, Seed | London, England, United Kingdom | http://www.seedcamp.com | Micro VC, Venture Capital | 14 |

| Octopus Ventures | Early Stage Venture, Late Stage Venture, Seed | London, England, United Kingdom | http://www.octopusventures.com | Venture Capital | 14 |

| FTX Ventures | | Nassau, New Providence, Bahamas | https://ftx.com | Micro VC | 14 |

| ParaFi Capital | | Greenwich, Connecticut, United States | https://www.parafi.capital | Hedge Fund, Private Equity Firm, Venture Capital | 13 |

| Coatue | Early Stage Venture, Late Stage Venture | New York, New York, United States | http://coatue.com | Hedge Fund, Private Equity Firm | 13 |

| Founders Fund | Debt, Early Stage Venture, Grant, Late Stage Venture, Private Equity, Seed | San Francisco, California, United States | http://www.foundersfund.com | Venture Capital | 13 |

| FJ Labs | Early Stage Venture, Seed | New York, New York, United States | http://www.fjlabs.com | Micro VC, Venture Capital | 13 |