Mexico-based commerce and digital payments platform Clip has received a $50m credit facility from Morgan Stanley, JP Morgan and HSBC.

This is a three-year, unsecured revolving credit facility.

With the funds, Clip plans to expand its efforts to meet businesses’ demand for innovative payments solutions and improve access for Mexican businesses and consumers.

The credit line also follows the launch of new products. Clip recently released three point-of-sale terminals, Clip Mini, Clip Pro 2 and Clip Stand. It also released two hardware accessories – Clip Cashbox and Clip Printer – and three remote payments software features – QR Code, Payment Link and URL Link.

Last month, the company received the approval for an Institution of Electronic Payment Funds license from the National Banking and Securities Commission. With this, Clip can open and hold customer accounts with electronic balances, offer wire transfers, and issue, market and manage forms of payment.

Clip founder and CEO Adolfo Babatz said “We see strong opportunity for growth in the near term.

“This credit facility represents another important milestone for Clip, as it provides additional support to our already solid balance sheet and liquidity position. It is important for Clip and our story to receive the support of banks of this calibre validating our mission of expanding financial inclusion in Mexico.”

Clip has offices in Mexico City, Guadalajara, Miami, Salt Lake City and Buenos Aires.

Mexico has a bustling FinTech sector. It recently welcomed its latest FinTech unicorn, with credit card company Stori reaching a $1.2bn valuation after it closed its Series C-2 round on $150m. Stori provides underserved populations with access to credit card products.

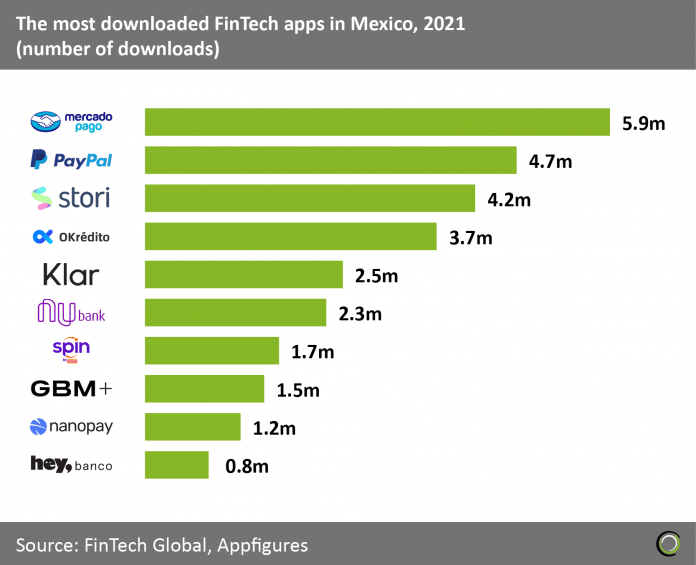

FinTech Global recently compiled research on the most downloaded FinTech apps in Mexico during 2021. The most downloaded was online payment platform Mercado Pago, which had 5.9 million downloads.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global