Last year’s jump in global RegTech activity was driven by increased investment in cybersecurity companies

Cybersecurity companies continue to be leading the growth of the global RegTech sector when it comes to investment.

Global RegTech deal activity experienced a continuous growth from 149 deals in 2015 to 164 transactions in 2018, before nearly doubling last year when 317 funding rounds were recorded. In each year all subsectors of the industry attracted capital as investors backed innovative and disruptive companies across the full spectrum of the compliance value chain.

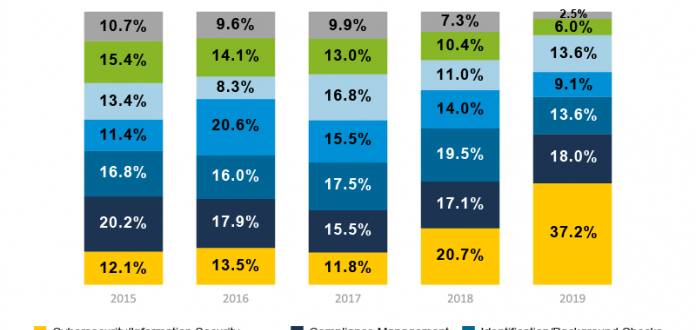

The jump in deal activity in 2019 was mainly driven by increased investment in Cybersecurity/Information Security companies which saw their share of total deal activity rise from 20.7% in 2018 to 37.2% last year. Deal activity in the sector was already steadily growing since 2015 but accelerated over the last 12 months as financial services companies are increasingly moving towards digital operations and expanding their security budgets. According to a study by Gov.uk, finance and insurance firms invested the most on cybersecurity, compared to other sectors of the economy, and their spending increased 23% YoY in 2019.

On the flip side, the share of deals completed by Transaction Monitoring companies has steadily declined over the period from 15.4% in 2015 to just 6.0% in 2019. Since companies in the subsector deal with established regulations such as 5AML and MiFID II investors have shifted their backing to other areas chasing higher returns in new opportunities in the RegTech market such as the EU’s General Data Protection Regulation, the UK’s SM&CR and information security.

Copyright © 2020 RegTech Analyst