Reconciliation solution Recko closes its Series A

Recko, an AI-powered reconciliation of digital transactions service, has scored $6m in its Series A round which was led by Vertex Ventures.

Buy now pay later platform Tabby closes $7m round

UAE-based Tabby, a buy now pay later service provider, has reportedly raised $7m in its seed funding round.

Netwrix closes majority investment from private equity firm TA Associates

Netwrix, a cybersecurity company that has a goal of making data security simple, has received a majority investment from private equity firm TA Associates. The...

Floating Point Group collects $2m for its seed round

Floating Point Group (FPG), which designs algorithmic systems for cryptocurrency trading, has collected $2m in its seed round.

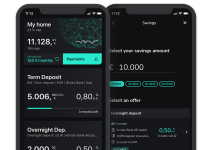

Scalable Capital offers new fixed-term deposits opportunities through Raisin deal

Digital wealth management company Scalable Capital will expand its product range with fixed-term deposits through new collaboration with Raisin.

Bench closes Series C to support relaunch

Bookkeeping platform for small businesses Bench has closed its Series C funding round on $60m to support its product relaunch.

TreasurySpring collects £2m in funding round led by ETFS

TreasurySpring, which delivers digital pipelines to connect cash rich firms and institutional borrowers, has scored a £2m funding round.

OceanEx closes Series A as it looks for global regulatory compliance

OceanEx, a cryptocurrency exchange, has closed its Series A to support its goal of reaching regulatory compliance globally.

Teamleader receives €18.5m in its Series C funding round

Teamleader a CRM, project management and invoicing platform, has received €18.5m in its Series C funding round.

Data centre leader VNET announces $299m strategic investment milestone

VNET Group, Inc., a carrier- and cloud-neutral internet data centre services provider in China, recently announced the completion of a significant strategic investment.