Crypto venture capital firm SPiCE VC closes pre-ICO on $40m

Cryptocurrency venture capital firm SPiCE VC has closed its pre-ICO sale on $40m, and has now launched its ICO.

London FinTech Paytrix lands $18.3m for its payments ecosystem

Paytrix, a London-based FinTech building a payments ecosystem to help businesses grow, has raised $18.3m in Series A funding to drive product development and international expansion.

LatiPay nabs $3m to connect China to New Zealand merchants

Auckland, New Zealand-based payments firm LatiPay has raised $3m in its Series A round as it looks to enter new markets.

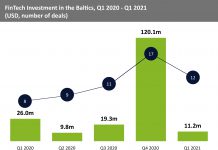

FinTech investment growth in the Baltics paused in Q1 due to lack of large...

FinTech companies in the region raised just $11.2m across 12 deals during the first three months of 2021

InsurTech platform EIS scores $100m funding from TPG to drive growth

San Francisco-based insurance technology firm EIS scored $100m in new growth funding from private equity investor TPG.

Stash swipes $9.25m for investment app

Investment app Stash has raised $9.25m in a Series A round of funding to accelerate user growth and build out its technology platform.

Refine Intelligence secures $13m in seed round to revolutionise AML

Refine Intelligence has announced a successful $13m seed funding round that is set enable them to transform Anti-Money Laundering (AML).

Tapline secures $31.7m pre-seed as it rises out of stealth

Digital finance platform Tapline has scored pre-seed funding of €31.7m in both equity and debt funding.

OnPay closes first external capital investment

Payroll startup OnPay has bagged $6m in its Series A round, which marks its first batch of external financing.

Invoier collects investment from European Innovation Council

Invoier, a marketplace for trading invoices, has received a €4.1m investment from the European Innovation Council (EIC) Fund.