Singapore scales up FinTech innovation with new global finance & technology network

The MAS has unveiled its latest strategic development in FinTech, the Global Finance & Technology Network (GFTN).

General Catalyst leads $25m Series A for revenue automation firm Tabs

Tabs, a leader in revenue automation for B2B businesses, announced today that it has secured $25m in Series A funding.

MIND emerges from stealth with $11m to transform data security landscape

MIND has emerged from stealth alongside the unveiling of its cutting-edge platform designed to protect the most sensitive data within organizations.

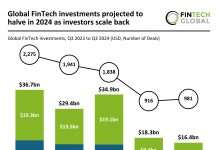

Global FinTech investments projected to halve in 2024 as investors scale back

Key Global FinTech investment stats in Q3 2024: Global FinTech deal activity dropped by 57% YoY

FinTech investments projected to halve in 2024 as...

Databento secures $10m investment to fuel global expansion in market data

Databento, an emergent leader in the market data industry, has successfully secured an additional $10m in funding.

BondBloxx secures $27m to bolster fixed income ETF offerings

BondBloxx Investment Management Corporation, a Larkspur, CA-based provider of bond ETFs, has successfully raised $27m in funding.

The governance gap: AI risks unchecked in financial services

Financial services companies are rushing to integrate artificial intelligence (AI) into their operations, but many are doing so without adequate governance frameworks or testing procedures.

Israeli FinTech Melio secures $150m led by US company Fiserv

Melio, an Israeli payments platform, has successfully raised $150m in a funding round spearheaded by the strategic US investor Fiserv. The financing, which values Melio...

How can RegTechs improve the overall security of in-house AI?

The vast and breakneck expansion of in-house AI solutions is leading to many companies scrambling to ensure such solutions are complaint and strongly secure....

Finfra secures $2.5m to boost embedded lending for Indonesian SMEs

Finfra, an Indonesian lending-as-a-service infrastructure provider, has successfully secured $2.5m in a funding round led by Cento Ventures.