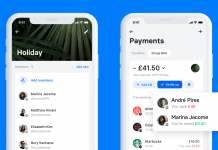

Revolut launches new bill-splitting feature Group Bills

Hot on the heels of reporting a tripling of its losses in the last year, UK neobank Revolut is now launching a new feature to make it easier to track, split and settle up expenses.

PropTech startup Obligo nets $15.5m in its Series A round

Obligo, which helps tenants rent an apartment without providing a security deposit, has scored $15.5m in its Series A round.

Is AI’s use in transaction monitoring changing?

AI’s use in transaction monitoring has not always been welcomed, but the market is changing, and it is quickly becoming core to these processes.

Pluto pulls in over £200k in crowdfunding campaign

Pluto, a mobile-based travel insurance platform, has raised £219,479 in a new crowdfunding campaign on Seedrs.

Starling Bank’s losses doubled to £53.6m in the last year

Even though UK-based FinTech unicorn Starling Bank has seen its losses skyrocket to reach £53.6m in the last year, it still has reason to celebrate.

Apttus adds two new members to its board of directors

Quote-to-cash and contract management platform Apttus has added former Cisco Systems EVP and CMO Sue Bostrom and Veeva Systems CFO Tim Cabral to its board of directors.

Loadsure secures funding to insurance the freight industry

InsurTech MGA Loadsure has raised $11m in Series A funding led by MMC Ventures for its freight insurance technology.

Hentsū completes funding from NEXT Ventures led round

Cloud-based online support solution for hedge funds and asset managers Hentsū has closed an undisclosed funding round.

Unlocking business potential: The power of Low Code No Code (LCNC) platforms

Low Code No Code (LCNC) software, a transformative innovation in the realm of application development, caters to individuals lacking coding experience. These platforms offer intuitive drag-and-drop interfaces, enabling users to craft applications effortlessly. InsurTech Ushur delves into the fundamental aspects of LCNC software, exploring its significance, key components, and the potential impact on businesses.

Shift Technology accelerates growth drive following $60m Series C

AI-powered InsurTech Shift Technology is powering on with its expansion plans following a $60m Series C funding round led by Bessemer Venture Partners. The round, which was joined...