Verisk CEO Lee Shavel appointed to U.S. Federal Advisory Committee on Insurance

Verisk, a global leader in data analytics and technology, has announced that its president and CEO, Lee Shavel, has been appointed to the Federal...

Legal battle brews as BNPL sector challenges CFPB’s regulatory overreach

The FTA, a consortium that includes FinTech companies like Klarna, has initiated a lawsuit against the CFPB in the U.S. District Court in Washington D.C.

Prudential Financial partners with 123Seguro to expand insurance services in Latin America

Prudential Financial, Inc. has entered a strategic partnership with 123Seguro to bring accident & health, life, and ancillary insurance products to Brazil and Mexico. The...

Liberty Mutual partners with Jaguar Land Rover to offer premium auto insurance to US...

Liberty Mutual, a leading global insurer, has formed an exclusive partnership with Jaguar Land Rover North America (JLR) to provide tailored auto insurance solutions...

Sophos acquires Secureworks in $859m deal to boost global cyber capabilities

Sophos and Secureworks, two names in the cybersecurity sector, have entered into an agreement where Sophos will acquire Secureworks.

Finzly launches instant payment service on AWS Marketplace

Finzly, a leading provider of payment solutions for financial institutions, has announced the launch of its instant payment service on AWS Marketplace. As an early...

Stream.Security lands $30m Series B to bolster cloud security capabilities

Stream.Security, the innovator in real-time cloud security solutions, has successfully closed a substantial $30m Series B funding round.

Equifax UK, OneID eye financial onboarding transformation with new solution

Equifax UK has teamed up with OneID, a pioneering digital identity provider, to enhance customer onboarding processes.

Thredd unveils U.S. payments market guide for FinTechs

Thredd, a leading next-generation global payments processor, has launched its latest complimentary report, “Launching in America: A guide to issuing via BIN sponsorship.” The guide...

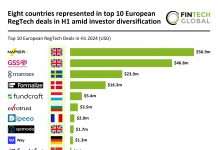

Eight countries represented in top 10 European RegTech deals in H1 amid investor diversification

Key European RegTech investment stats in H1 2024: European RegTech investments halved in H1 YoY

Investors diversify as eight countries represented in the top...