Finastra launches Loan IQ Simplified Servicing to streamline SME loan management

Finastra, a leading global provider of financial software applications and marketplaces, has announced the launch of its Loan IQ Simplified Servicing solution. This new offering...

Zip boosts valuation to $2.2bn with $190m in Series D raise

Zip, an enterprise software firm, has raised $190m in a Series D funding round, boosting the company's valuation to $2.2bn.

Tietoevry Banking and Tapster link to transform wearable payments in Europe

Tietoevry Banking, a provider of financial solutions, has entered into a agreement with the paytech innovator Tapster.

Mastercard launches Connect Plus to enhance data control in open banking

Mastercard, a global leader in payment solutions, has launched a new product to give consumers more control over how their financial data is shared...

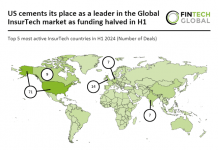

US cements its place as a leader in the Global InsurTech market as funding...

Key Global InsurTech investment stats in H1 2024: Global InsurTech investments halved in H1 YoY

US companies cemented its place on the Global InsurTech...

CaixaBank’s strategic alliance with Apple revolutionises e-commerce payments in Europe

CaixaBank, a leader in mobile payments, has joined forces with Apple, a global technology giant, to enhance the digital banking experience for its customers.

BNY partners with Kanexa to revolutionise open account automation

BNY, The Bank of New York Mellon Corporation, is a powerhouse in global financial services, while Kanexa stands as a leading figure in automation solutions.

Sharegain and DriveWealth team up to revolutionise securities lending for online brokers

Sharegain, a leading securities lending FinTech, and DriveWealth, a prominent financial technology platform known for its Brokerage-as-a-Service offerings, have recently unveiled a strategic partnership aimed at expanding opportunities within the securities lending market globally.

Swift and Nium join forces to streamline global financial transactions

Nium, the leader in global infrastructure for real-time cross-border payments, has teamed up with Swift, the renowned provider of secure financial messaging services.

Tookitaki’s anti-financial crime technology garners investment for growth in key Asian markets

Tookitaki, a leader in anti-financial crime software, has recently secured a strategic investment from True Global Ventures (TGV) Opportunity Fund.