Cyera expands AI data security reach with $162m acquisition of Trail Security

Cyera, an AI-powered data security firm, has completed the acquisition of Trail Security, a data loss prevention firm, for $162m.

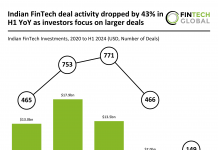

Indian FinTech deal activity dropped by 43% in H1 YoY as investors focus on...

Key Indian FinTech investment stats in H1 2024: Indian FinTech deal activity decreased by 43% YoY

Average deal size increased from $12.7m to $16m...

Pivot Payables enhances B2B payments with new American Express Sync integration

Pivot Payables, a leading FinTech firm specializing in corporate financial operations solutions, has announced a groundbreaking integration with American Express. This collaboration marks a significant...

Worldline expands European presence with new account-to-account payment method

Worldline, a prominent player in the payment services sector, has recently unveiled its latest offering, “Bank Transfer by Worldline”.

OneDegree Global collaborates with DB to launch Korea’s first cloud-based microinsurance platform

OneDegree Global, a trailblazer in digital insurance solutions, and DB Inc., have come together to innovate in the rapidly evolving insurance industry.

Kalepa’s AI copilot set to propel Bishop Street underwriters into future of InsurTech

Bishop Street Underwriters, owned by RedBird Capital Partners, collaborates with InsurTech pioneer Kalepa to leverage innovative AI technologies for enhancing underwriting decisions.

Quiet week for FinTech deals with only 13 recorded

Despite $736m being raised across all funding rounds recorded by FinTech Global this week, there were only 13 key deals reported. The leading funding...

Akur8 and ICPEI partner to revolutionise insurance pricing in Canada

Akur8, a next-generation insurance pricing and reserving platform powered by Transparent AI, has partnered with the Insurance Company of Prince Edward Island (ICPEI), a leading provider of personal and business insurance across Canada.

Why DevSecOps is essential for securing Agile and DevOps environments

Security remains a critical concern within the software industry. Since 2000, a staggering number of individuals—over 3.5 billion—have had their personal data compromised due to security breaches. The complexity and breadth of software applications today only widen the potential for vulnerabilities, highlighting the urgency for robust security measures.

Revolutionize your WealthTech platform with ByAllAccounts’ Tax Lot Data feature

ByAllAccounts is transforming the landscape of WealthTech with the introduction of its open and closed tax lots data.