Over 60% of UK consumers see mobile app fraud as top security threat

In a study conducted by the OWASP and Appdome, concerns over mobile app fraud are increasingly alarming among UK consumers. According to Finextra, the significant...

mea platform strengthens AI collaboration with AXIS for streamlined insurance operations

mea platform is set to bolster AXIS Capital's operational efficiency by leveraging its advanced GenAI technology, as part of its renewed partnership. This expanded partnership...

Record-breaking fines and new legal precedents set in Q3 2024 regulatory crackdown

Regulators intensified their enforcement actions in the Q32024, setting unprecedented records in the number and magnitude of penalties, according to a report from global...

Bloomberg unveils nature risk assessment tool for global investors

Bloomberg has launched a solution designed to provide investors with a comprehensive assessment of nature-related impacts and dependencies across a company's value chain for...

Burns & Wilcox UK teams up with Optalitix to streamline pricing models and optimise...

InsurTech firm Optalitix is set to implement its advanced solutions the operational efficiencies of Burns & Wilcox’s CRM and underwriting systems, as part of...

IFS unveils cloud-based sustainability management module with PwC

IFS, the global leader in enterprise cloud solutions and industrial AI, has launched its latest innovation, the Sustainability Management Module.

Mastercard opens Pune Tech Hub to drive technological innovation and global operations

Mastercard, a global payments technology company, has inaugurated a new, state-of-the-art Tech Hub in Pune, India. The decision to launch the new Tech Hub stems...

Klarna signs strategic agreement with Elliott Advisors to fund £30bn of UK transactions

Klarna has signed a strategic agreement with Elliott Advisors to fund £30bn of UK transactions through the sale of its short-term, interest-free product receivables. The...

How automated CDI cuts processing times by 32%

Client onboarding in the banking sector can be dauntingly slow and resource-intensive, often stretching beyond 90 days to incorporate a single corporate client. According...

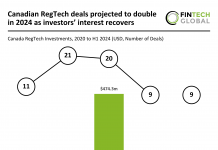

Canadian RegTech deals projected to double in 2024 as investors’ interest recovers

Key Canadian RegTech investment stats in H1 2024: Canadian RegTech funding increased by 86% YoY

Trend analysis showed Canadian RegTech deal volume for the...