Transforming banking efficiency with Corporate Digital Identity technology

Banks are consistently faced with the dual challenges of optimizing operations and enhancing both efficiency and employee satisfaction.

One Inc and J.P. Morgan Payments to deliver unified digital payment solutions for P&C...

One Inc, the leading payments network for the insurance industry, has expanded its collaboration with J.P. Morgan Payments to deliver a comprehensive, unified payment...

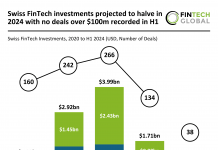

Swiss FinTech investments projected to halve in 2024 with no deals over $100m recorded...

Key Swiss FinTech investment stats in H1 2024: Zero deals of $100m or over were recorded in H1, resulting in a 60% drop in...

Invex Ventures bolsters FinTech portfolio with strategic acquisition of Manigo

Manigo, a prominent London-based fintech infrastructure platform, today announced its acquisition by Invex Ventures, a seasoned investor in the FinTech sector.

Acquired.com secures £4m funding to boost recurring commerce solutions

Acquired.com, the innovative payments platform specialising in recurring commerce, announced today a significant stride in their growth trajectory. The company, recognised for its next generation...

PXP Financial joins forces with Kushki to revolutionize payment solutions in Latin America

PXP Financial, a prominent provider of global payment services, has announced a strategic partnership with Kushki, a key player in the payment platform sector in Latin America.

Stoïk secures $27m in Series B to bolster cyber insurance for European SMEs

Stoïk, a French InsurTech startup, recently secured Series B funding of €25m ($27m). The round was led by Alven, with participation from Andreessen Horowitz, Munich...

Warburg Pincus invests $125m in Contabilizei, boosting automation in Brazilian accounting

Contabilizei, the largest accounting firm in Brazil, today announced securing a substantial $125m investment from global growth investor Warburg Pincus.

Imprint secures $75m in Series C to revolutionise co-branded credit cards

Imprint, the innovative provider of co-branded credit cards, announced a significant boost in funding with a $75m Series C round.

The natural tension of compliance and technology in financial institutions

While technology is essential for modern compliance programs, it can often be a source of natural tension for compliance