Michigan Planners enhances health plans with Gradient AI’s SAIL underwriting platform

Gradient AI, a prominent enterprise software provider, has partnered with Michigan Planners, a full-service insurance agency, to provide more accurate risk assessments and better-customised...

hyperexponential introduces innovative reinsurance pricing model

hyperexponential, a global pricing platform provider for re/insurers, has introduced its first templated reinsurance pricing model, designed for treaty reinsurance, including Excess of Loss...

Volt Underwriting launches with $25m capacity for energy sector risks

Volt Underwriting has officially launched as an approved coverholder, backed by Dale Underwriting Partners’ Lloyd’s Syndicate 1729, with support from MGA Accelerator DA Strategy. The...

Deutsche Bank introduces next-gen banking ecosystem for financial institutions

Deutsche Bank, a leading global financial services provider, has announced the launch of dbX, its next-generation integrated correspondent banking ecosystem. The platform was developed to...

Revolut launches new POS terminal for large businesses ahead of Black Friday

Revolut, a global FinTech company known for its versatile digital banking services, has launched a new point-of-sale (POS) terminal device aimed at larger businesses...

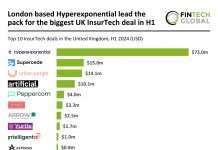

London based hyperexponential lead the pack for the biggest UK InsurTech deal in H1

Key UK InsurTech investment stats in H1 2024: UK InsurTech deal activity dropped by 32% in H1 2024 YoY

The average deal size completed...

The cost of overlooking compliance in challenger banks

Launching a new consumer and commercial bank involves numerous complexities and is a very costly venture. Ignoring compliance comes with a heavy price.

theScreener and MSCI join forces to transform ESG data integration

theScreener, a leading provider of financial analytics, has recently announced its collaboration with MSCI. This partnership is set to significantly enhance theScreener's Environmental, Social, and...

How to define organisational boundaries for CSRD compliance

The CSRD aims to elevate and standardise sustainability disclosures for companies both within and outside the EU that operate across Europe.

Australian government launches initiative to boost small business cyber resilience

The Australian government has unveiled a significant initiative, unveiling the Small Business Cyber Resilience Service with an investment of $11.1m. Aimed at bolstering cyber...