Beyond rules-based systems: The future of AML compliance with AI and federated learning

From traditional methods to advanced AI technologies, anti-money laundering (AML) compliance has experienced significant transformation.

Understanding the impact of the SEC’s Marketing Rule on financial advisors in 2024

In late 2022, the SEC implemented Rule 206(4), marking a significant change in compliance requirements for Investment Advisers (IAs).

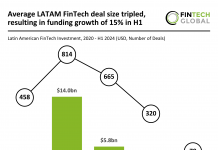

Average LATAM FinTech deal size tripled, resulting in funding growth of 15% in H1

Key LATAM FinTech investment stats in H1 2024: LATAM FinTech funding increased by 15% YoY

Average deal value rose by almost 3x as investors...

FinTech funding surpasses $1bn on strong week for the sector

This week's overall FinTech funding surpassed $1bn as the sector continued its forward momentum. Overall, 21 deals took place over the past seven days, with...

Intelligent AI and BCIS launch AI-driven platform to revolutionise property rebuild cost assessments

Intelligent AI, an InsurTech leader, has formed a strategic partnership with the Building Cost Information Service (BCIS), a renowned entity with over six decades of expertise in compiling and analysing construction costs.

Lakeside Bank partners with Volante Technologies to revolutionise real-time payments

Lakeside Bank and Volante Technologies have embarked on a strategic partnership aimed at transforming Lakeside's payment processing capabilities.

Relyance AI’s $32m funding boost aims to revolutionize AI data governance in enterprises

Relyance AI, a leader in AI-powered data governance, announced a significant $32.1m Series B funding round led by Thomvest Ventures, with substantial contributions from M12, Microsoft Ventures Fund.

AI-driven Numeric raises $28m to enhance real-time accounting solutions

Numeric, an innovative AI accounting automation platform headquartered in San Francisco and New York, has successfully closed a $28m Series A funding round.

Duck Creek Technologies expands capabilities with acquisition of Risk Control Technologies

Duck Creek Technologies, an intelligent solutions provider reshaping the future of property and casualty (P&C) insurance, has acquired Risk Control Technologies (RCT) in a bid...

Akur8 selected by RSM to bolster its insurance pricing process

Akur8, the next-generation insurance pricing and reserving platform, has been selected by RSM to enhance its insurance pricing process. The partnership is aimed at enabling...