How Doc Juicer became the go-to source for fraudulent document templates

Doc Juicer, also known as a template farm on steroids, has made a significant mark in the template industry by amassing a vast catalog of over 18,000 templates across more than 50 categories.

How artificial intelligence is redefining identity verification processes

Identity verification is a critical safeguard in the digital age, serving as a primary defence against fraud and ensuring that only genuine customers access...

Lemon and Shawbrook Bank launch first-of-its-kind SaaS financing solution for SMBs

Lemon, a Software-as-a-Service (SaaS) finance gateway, has announced the launch of a first-of-its-kind financing product in partnership with Shawbrook Bank. This collaboration aims to unlock...

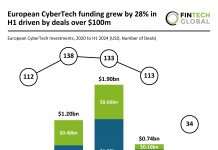

European CyberTech funding grew by 28% in H1 driven by deals over $100m

European CyberTech investment stats in H1 2024: European CyberTech funding increased by 28% YoY

Average deal value for H1 increased to $13.8m driven by...

Pockit acquires Monese for £15m to strengthen financial inclusion for low-income customers

Pockit, a UK-based FinTech focused on providing financial services to underserved consumers, has announced its acquisition of Monese, a pan-European FinTech with a similar...

Stripe and NVIDIA intensify partnership to boost global AI access and enhance fraud detection...

Stripe, a leader in financial infrastructure for businesses, has announced an enhanced collaboration with NVIDIA, a pioneer in AI and accelerated computing, to further develop artificial intelligence capabilities and advance fraud detection for its clients.

Moneybox and GoCardless enhance savings with renewed payment partnership

Moneybox, a renowned savings and investing platform, has extended its partnership with GoCardless, a leading bank payment company.

Revolut Business enhances UK merchant payments with American Express partnership

Revolut Business has partnered with American Express to extend payment method options for its UK merchants.

Dynasty Financial Partners secures strategic investment to boost FinTech innovations

Dynasty Financial Partners, a prominent player in the FinTech sector, has successfully closed a minority capital raise aimed at accelerating its growth trajectory.

Nada secures $25m from Kawa to expand innovative home equity solutions

Nada, a leading FinTech company known for offering homeowners debt-free access to home equity, has recently secured a revolving credit facility of up to $25m from Kawa Capital Management.