Kayna, WTW and Vibrant partner to enhance vendor cybersecurity and insurance solutions

Kayna, an award-winning embedded insurance infrastructure platform; WTW, a global advisory, broking, and solutions leader; and Vibrant, a cybersecurity oversight platform, have joined forces...

AI risk management pioneer Calvin Risk secures $4m in seed funding

Calvin Risk, an ETH Zurich spin-off specialising in AI risk management and governance, has raised $4m in a seed funding round led by Join...

DigitalOwl and ExamOne join forces to revolutionise life insurance underwriting

DigitalOwl, a provider of advanced AI solutions tailored for the life insurance and legal sectors, has announced a new partnership with ExamOne which aims...

Skyward Specialty unveils new insurance solution for life sciences sector

Skyward Specialty Insurance Group, Inc., a leader in the specialty property and casualty (P&C) insurance market, has introduced its new Life Sciences liability coverage. The...

Insurity appoints Jonathan Victor as COO to drive growth

Insurity, a leading provider of cloud-based software solutions for insurance carriers, brokers, and managing general agents (MGAs), has announced the promotion of Jonathan Victor...

Atom becomes first UK bank to commit to being carbon positive by 2035

Atom Bank, the UK’s first app-only bank, has made headlines by purchasing 25 acres of newly planted broadleaf woodland in Northumberland, as it becomes...

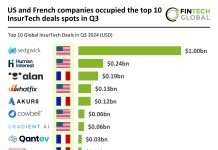

US and French companies occupied the top 10 InsurTech deals spots in Q3

Key Global InsurTech investment stats in Q3 2024: Global InsurTech deal activity dropped by 49% YoY

US and French companies completed all of the...

Temenos and NVIDIA partner to deliver on-premises generative AI for banks

Temenos, a leading provider of banking software solutions, and NVIDIA have announced a partnership to bring high-performance, on-premises generative AI solutions to banks. The collaboration...

NatWest Group partners with NCR Atleos to revolutionise self-service banking

NatWest Group, one of the UK’s largest banking organisations serving over 19m customers, has expanded its collaboration with NCR Atleos Corporation to modernise its...

NatWest Group partners with NCR Atleos to transform self-service banking

NatWest Group, one of the UK’s largest banking institutions with over 19 million customers, is taking a significant step forward in modernising its self-service banking capabilities.