The importance of AML for non-financial institutions

Anti-money laundering compliance is usually associated with financial institutions; however, Sentinels has revealed how and why non-finance firms should also protect themselves.

Hawk AI joins the Visa Fintech Partner Connect program

Hawk AI, a software developer for issuers, banks, FinTechs and payment firms, has joined the Visa Fintech Partner Connect program.

NetGuardians releases new anti-money laundering solution

NetGuardians, an enterprise risk platform helping to combat fraud, has launched its new anti-money laundering (AML) transaction monitoring solution.

Crypto trading platform X1 selects Resistant AI to aid AML checks

Cryptocurrency trading platform X1 has chosen financial crime prevention specialist Resistant AI to improve its AML checks across its platform.

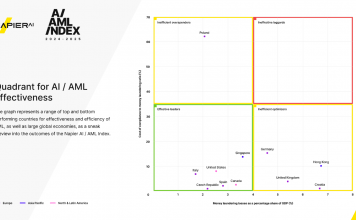

Arctic Intelligence releases second AML Industry Benchmarking Report 2022

The biggest challenge that compliance teams face with their money laundering and terrorist financing (ML/TF) risk assessments are gathering the data and evidencing effectiveness.

Hawk:AI teams up with 42flows.tech for AI-powered AML

Hawk:AI, which offers anti-money laundering (AML) surveillance technology, has partnered with Estonian IT company 42flows.tech, to bring AML and fraud surveillance to more global customers.

Face biometric verification dev iProov teams with Microblink

Face biometric verification and authentication technology developer iProov has partnered with AI-powered computer vision software provider Microblink.

Estonian FinTechs Salv, Tuum partner for AML capabilities

RegTech company Salv will deploy its AML capabilities into Tuum, an API-first and modular core banking platform.

Resistant AI, ComplyAdvantage partner for anti-financial crime

Resistant AI has deployed its AI and machine learning financial crime prevention solution to financial crime risk data and detection technology platform ComplyAdvantage, in a new deal.

The role of KYC and AML in banking

In a hyperconnected and digital world, the importance of KYC and AML in finance cannot be understated. For banking, what do these processes include?