Indian neobank Klear Money is gearing up for a launch

The challenger bank industry is about to become even more crowded with Klear Money reportedly gearing up to launch in India.

Koine recieves e-money authorisation from UK’s FCA

Koine, which offers segregated, institutional custody and settlement of digital assets, has received authorisation from the UK’s Financial Conduct Authority (FCA) for the issuance of electronic money.

Savings app that pays users for financial literacy Plinqit closes Series A

Plinqit has closed its Series A round on $5m to support the development of its platform, which it claims is the only platform to pay users to learn about personal finances.

Tide names first non-executive chairs and hints of upcoming Series C

FinTech Tide has named Donald Brydon as its first independent non-executive chair at the same time as the London-based startup hints of an upcoming Series C round.

Hardbacon secures $50,000 grant to develop AI tool

Hardbacon, a budgeting and investment tracking mobile app, has netted $50,000 in a funding round to support its AI development.

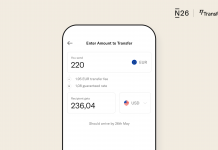

N26 and TransferWise take their partnership up a notch with a new extension

German challenger bank N26 has extended its partnership with international payments company TransferWise, which will enable it to offer more options for foreign currency transfers.

BearingPoint RegTech launches new solution to reduce complexity for banks

BearingPoint RegTech has launched an outsourcing solution for regulatory reporting that will diminish the cost of compliance for institutions.

The UK’s newest neobank Alba picks Temenos’ tech to be the backbone of its...

Alba is a new UK-based challenger bank that is looking to launch in 2020. As part of its push, it has now teamed up with banking software company Temenos.

CSS expands aosphere alliance to integrate data services with investment platform

Compliance Solutions Strategies (CSS) has expanded its collaboration with legal firm aosphere to integrate the latter’s market data services with CSS’ investment monitoring platform.

Open banking bounces back, Tink reports

According to research published by open banking platform Tink, there has been an increase in spending among Europe’s financial executives, with 47% saying their...