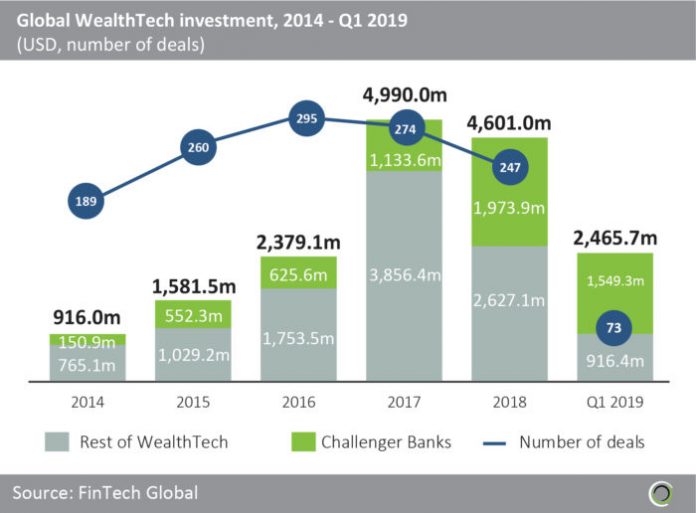

WealthTech companies raised almost $2.5bn last quarter

- More than $16.9bn has been raised by WealthTech companies globally over the past five years, with investors participating in over 1,300 transactions in the space since 2014.

- Investment increased at a CAGR of 49.7% between 2014 and 2018 with average deal sizes almost quadrupling from $4.8m to $18.6m during the period.

- WealthTech has witnessed a proliferation of Challenger Banks spring up over the past five years with aims of disrupting traditional legacy banking and attracting a growing millennial customer base. This has driven significant growth in WealthTech funding with just over a third of total global funding since 2014 invested in challenger and digital banks.

Passion Capital has been the most active investor in Challenger banks globally since 2014

- With opportunities to topple incumbent legacy banks and adopt a technology first approach to banking, investors have poured almost $6bn into Challenger Banks since 2014.

- There have been more than 300 different investors in Challenger Banks, across 219 deals since 2014, and the 10 most active investors have completed 57 transactions between them.

- London based VC, Passion Capital has been the most active investor in Challenger Banks over the past five years having completed 10 deals. Digital only bank Monzo, raised a $108.5m Series E round in Q4 2018 which propelled it to unicorn status. This is Passion Capital largest deal in the Challenger bank space to date. Passion capital has also invested in London-Tide, which provides digital banking services small businesses and the self-employed.

- Ribbit Capital has been the most active US-based investor in the space, having been involved in six deals since 2014. Ribbit participated in Revolut $250m Series C round in Q2 2018, led by DST Global, pushing the Challenger Banks valuation to $1.5bn.

Challenger banks raise record amount of funding in Q1 2019

- WealthTech investment and deal activity had been in a downtrend throughout 2018, dropping from $1.8bn in Q1 to $774.5m in Q4 and deals falling from 68 transactions to 52 deals during the year.

- Funding in Q1 2019 stymied this downward trend, with almost $2.5bn raised by WealthTech companies during the quarter, 36.2% higher than in Q1 2018.

- Record funding of over $1.5bn in Challenger Banks was the driving force behind this growth, with digital banks absorbing almost two thirds of the total capital raised by WealthTech companies last quarter.

- London-based business only Challenger Bank, OakNorth, raised $440m of funding in February 2019, led by SoftBank Vision Fund, at a $2.4bn valuation cementing its Unicorn status.

Challenger Banks dominate the top 10 WealthTech deals in Q1 2019

- Almost $1.7bn was invested in the 10 largest WealthTech deals globally last quarter, with Challenger Banks raising over $1.4bn of this across seven transactions.

- Raisin, a personal saving platform based in Berlin, raised a $114m Series D round from PayPal, Index Ventures, Ribbit Capital, and Thrive Capital. Initially focused on its native Germany, the company plans to use the new capital for strategic acquisitions and further internationalisation.

- Another German company, Berlin-based N26, raised a $300m Series D round in January 2019, to expand its global operations and achieve its target of onboarding 100 million customers worldwide. This investment, led by Insight Venture Partners, values the challenger at $2.7bn.

- Metro Bank, ClearBank and Starling Bank all received significant funding as part of the larger RBS Capability and Innovation Fund, with all three planning to improve products and services for UK SMEs. This investment from RBS is part of a scheme requiring the bank to boost competition in the sector as a condition of its bailout during the 2008 financial crisis. Starling Bank also raised $96.6m in a Series C round from Merian Global Investors and QuanRes in February 2019. Since launching its app in May 2017, Starling has built up a customer base of 460,000 personal current accounts and 30,000 SME accounts.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ?2019 FinTech Global