Tag: BNPL

BNPL tabby closes $50m Series B to expand portfolio and market...

UAE-based buy now, pay later (BNPL) company tabby has concluded a $50m Series B funding round led by Global Founders Capital and STV.

Telr launches BNPL platform following tabby partnership

Dubai-based payments gateway company Telr introduced a buy now, pay later (BNPL) solution after entering a partnership with compatriot BNPL firm tabby.

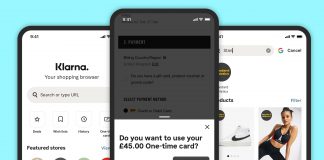

BNPL giant Klarna launches interest-free shopping app which can be used...

Banking, payments and shopping service Klarna launched its Shopping app, enabling users to pay in any online shop directly through the Klarna app, eliminating the need to use a credit card.

US rapper A$AP Rocky invests in BNPL giant Klarna, becomes its...

Rakim Mayers, better known as A$AP Rocky, has become a shareholder in Sweden-based FinTech unicorn Klarna and assumed the role of company CEO for a day.

Does regulation pose a threat to buy now, pay later market...

The BNPL market has seen a financial boon in recent years, creating market leading behemoths like Klarna, Affirm and Afterpay – who are all recording strong growth on the back of clear market demand. Could a growing call for regulation in the sector change this?

Affirm spin-off Resolve bags $60m to bolster B2B billing offering

US PayTech Resolve has raised $60m in funding to expand its embedded billing platform for business-to-business (B2B) companies.

Zip strengthens grip on BNPL market with Twisto, Spotii acquisitions

Australian buy now, pay later (BNPL) company Zip will expand into Europe and the Middle with the purchases of BNPL competitors Twisto and Spotii.

BNPL firm Sunbit secures unicorn status following $130m Series D

California-headquartered buy now, pay later (BNPL) company Sunbit has achieved unicorn status after a $130m Series D brought its value up to $1.1bn.

Klarna rival Laybuy hauls in A$35m to boost its footprint in...

New Zealand-based buy now pay later firm Laybuy has closed a A$35m capital raise to further its push into the UK market.

MAS to examine buy now pay later schemes for stricter regulation...

Amidst the popularity of buy now, pay later (BNPL) solutions, the Monetary Authority of Singapore (MAS) has raised growing concerns over consumers drowning in unseen debt.