Tag: Financial Conduct Authority

Streamlining AML compliance: The future of FinTech operations

In the ever-evolving landscape of financial services, maintaining regulatory compliance is not just a legal requirement but a strategic advantage. As financial institutions navigate...

Understanding the UK’s Sustainability Disclosure Requirements for 2024

The UK is gearing up to introduce the Sustainability Disclosure Requirements (SDR) in 2024, marking a significant shift in the Environmental, Social, and Governance (ESG) regulatory landscape. This pioneering legislation is set to standardise how asset owners and managers communicate and market their sustainable investment products. Through a mix of anti-greenwashing rules, investment labelling, and disclosures, the SDR aims to assist investors in making informed choices about sustainable finance products and investments.

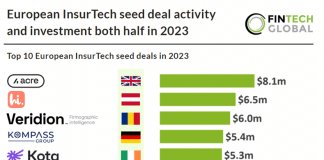

European InsurTech seed deal actvity and investment both half in 2023

Key European InsurTech seed investment stats in 2023:

• European InsurTech seed companies raised a combined $87m in 2023, a 52% drop from 2022

• European...

Mondu amplifies European growth with €30m in additional financing from VVRB

Mondu, the burgeoning B2B payments company, has successfully secured an additional €30m in debt financing from the German financial institution, Vereinigte Volksbank Raiffeisenbank (VVRB). This new injection of funds raises Mondu's total financing to €50m, following an initial €20m loan obtained from VVRB in late 2022.

Navigating the regulatory minefield: Record fines highlight 2023’s compliance challenges

In 2023, the global regulatory landscape unveiled a startling revelation as fines imposed by authorities exceeded a colossal $10.5bn. This figure not only reflects the stringent enforcement actions but also spotlights the emerging areas of regulatory scrutiny.

Payhawk obtains UK EMI license and announces new leadership additions

Payhawk, the global spend management solution, has obtained a licensed Electronic Money Institution (EMI) status in the United Kingdom.

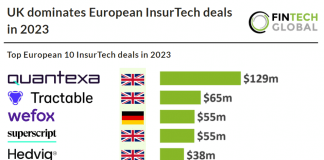

UK dominates European InsurTech deals in 2023

Key European InsurTech investment stats in 2023:

• European InsurTech deal activity totalled at 126 deals in 2023, a 44% reduction from the previous year

•...

The rise of money mules in UK fraud: Prevention and detection

Fraud in the UK has become a significant concern, with 40% of crimes being fraudulent. Money muling is at the forefront, where fraudsters utilise synthetic or real mule accounts for financial gain. The UK government, recognizing the seriousness, plans to publish an action plan to combat this issue.

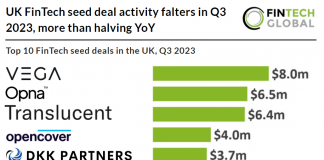

UK FinTech seed deal activity falters in Q3 2023, more than...

Key FinTech seed deal stats in Q3 2023:

• UK FinTech seed deal activity reached 37 deals in Q3 2023, a 58% decline from the...

NatWest’s innovative step in Open Banking with “Enriched Transactions” service

NatWest, a digital-focused relationship bank championing potential for the 19 million individuals, families, and businesses they serve in the UK and Ireland, has unveiled their innovative service called Enriched Transactions.