Tag: hyperexponential

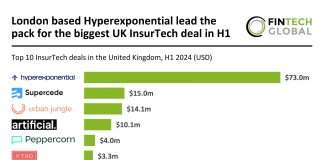

London based hyperexponential lead the pack for the biggest UK InsurTech...

Key UK InsurTech investment stats in H1 2024: UK InsurTech deal activity dropped by 32% in H1 2024 YoY

The average deal size completed...

UK InsurTech market recorded zero deals over $100m in the first...

Key UK InsurTech investment stats in H1 2024: UK InsurTech investments continued to drop in H1 2024, which caused the region to not report...

AI’s role in revolutionising the insurance industry

At the inaugural hx Live conference, hyperexponential’s co-founder and CEO, Amrit Santhirasenan, delved into the company’s innovative approach to artificial intelligence (AI), and opened up on AI’s role in revolutionising the insurance industry.

hyperexponential and Send announce strategic partnership to enhance insurer pricing

hyperexponential and Send have announced a strategic partnership aimed at streamlining the pricing process for insurers.

How hx Renew’s CUICs are revolutionising insurance pricing

Charts and visualisations are integral to pricing models, but traditional tools like Excel and standard Python charts come with limitations. What happens if your datatypes differ from what the chart requires? Or if you need to dynamically update your chart based on the insurance layers selected? Highlighting high-risk exposures in red might also be challenging. Performing these tasks in Excel or with standard Python charts can be cumbersome and sometimes impossible.

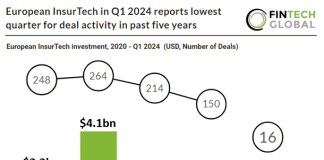

European InsurTech Deal Activity Drops

Key European InsurTech investment stats in Q1 2024

• European InsurTech deal activity totalled at 16 transactions in Q1 2024, a 57% drop from Q1...

UK InsurTech hyperexponential appoints Risa Ryan to lead US expansion

UK InsurTech hyperexponential, a leader in data-driven pricing solutions for the insurance industry, has appointed Risa Ryan as head of US P&C to spearhead the company’s expansion into the US market.

Cytora unveils Risk Flow Academy for insurance professionals

Cytora, has introduced the Risk Flow Academy, a pioneering digital learning platform designed for commercial insurance professionals. This free resource is the first of its kind to offer comprehensive training in digital risk processing, setting a new standard for the industry.

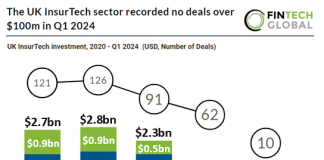

The UK InsurTech sector recorded no deals over $100m in Q1...

Key UK InsurTech investment stats in Q1 2024:

• UK InsurTech deal activity reached 10 deals in Q1 2024, a 58% drop from Q1 2023

•...

Gain an edge in pricing decision intelligence with hx Renew’s specialist...

Nearly one year ago, hyperexponential launched a certification programme, beginning with the "Core Model Developer Exam." The initiative has been warmly received, with certificates and badges being awarded quarterly. The enthusiasm for this achievement is visible, with many sharing their hx Renew certificates on LinkedIn, celebrating their success.