Tag: Regulatory Technology

Chartis and Hawk reveal AI’s compliance breakthrough

A new global study from Chartis and Hawk has revealed that FinTech and payment companies are entering a more advanced stage of artificial intelligence...

How US fund managers are re-engineering compliance

For years, offshore structures were seen as the pinnacle of efficiency—offering speed, privacy, and favourable tax treatment for fund managers and investors alike.

But...

How to detect and control compliance risks in aiComms

Artificial intelligence has evolved from a background productivity tool into an active participant in day-to-day communications.

From composing emails and instant messages to preparing proposals,...

Seyfi Günay joins SmartSearch to drive growth strategy

SmartSearch, the UK’s leading provider of digital compliance and anti-money laundering (AML) solutions, has announced the appointment of Seyfi Günay as chief revenue officer.

Günay...

Why PRAUC is the true test of AML model performance

Determining how effective an anti-money laundering (AML) model truly is has become a major challenge for financial institutions.

Research from PwC shows that 90–95% of...

Rethinking AML: Compliance as a FinTech growth driver

FinTech founders have long been told to prioritise speed over structure—launch fast and worry about compliance later. But this mindset can quickly backfire. When...

Automating enterprise-grade compliance with AI

Keeping up with global regulatory change has never been more complex. With 1,374 regulatory agencies overseeing financial institutions worldwide, firms face a relentless wave...

How automation enhances KYB and business verification

As global business transactions grow increasingly complex, the need for effective Know Your Business (KYB) workflows has never been greater.

In 2024, the Federal Trade...

Navigating AML and sanctions in North America

The AML and sanctions landscape in North America is evolving rapidly, shaped by regulatory change, heightened scrutiny, and the rise of AI-driven compliance tools.

Financial...

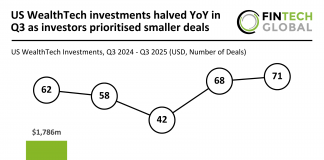

US WealthTech investments halved YoY in Q3 as investors prioritised smaller...

Key US WealthTech investment stats in Q3 2025: US WealthTech investments halved YoY in Q3

Average deal value dropped to $12.1m as investors prioritised...