Tag: Wellington Management

US firms continue to dominate the global FinTech market securing six...

Key global FinTech investment stats in Q4 2025: Global FinTech investments increased by 53% YoY

US firms secured six of the top 10 deals...

Digital bank Trade Republic valued at €12.5bn in €1.2bn deal

Trade Republic has strengthened its shareholder base as part of a major secondary transaction that values the business at €12.5bn, underscoring sustained investor confidence...

Trust tech leader Vanta bags $150m to scale AI platform

Vanta, an AI-powered trust management platform that helps businesses automate and scale compliance, has raised $150m in a Series D funding round.

The round was...

Tabby lands $160m funding to accelerate financial services growth in MENA

Tabby, a leading financial services and shopping app in the MENA region, has secured $160m in a Series E funding round, pushing its valuation to $3.3bn.

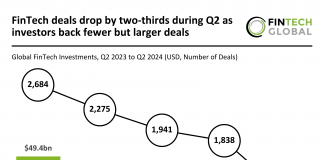

FinTech deals drop by two-thirds during Q2 as investors back fewer...

Key global FinTech investment stats in Q2 2024: Global FinTech deal activity reduced by two-thirds in Q2 2024 YoY

Average deal size increased to...

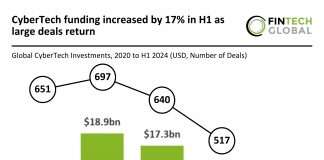

CyberTech funding increased by 17% in H1 as large deals return

Global CyberTech investment stats in H1 2024: CyberTech funding globally increased by 17% YoY

Average deal value for CyberTech deals in the half increased...

AI-Native firm Abnormal Security raises $250m, valuing at $5.1bn

Abnormal Security, the forefront in AI-native human behavior security, has successfully closed its Series D funding round on $250m, which has propelled the company's valuation to an impressive $5.1bn.

Saudi FinTech Tabby achieves $1.5bn valuation after latest fundraising

Saudi Arabia's Tabby, a leading buy-now-pay-later firm, is making headlines with its recent valuation and funding accomplishments.

Digital assets platform FalconX soars to $8bn valuation

Digital assets platform FalconX has soared to $8bn valuation after closing its Series D round on $150m.

Creditas lands funding amid Latin American FinTech boom

Brazil-based online lending solution provider Creditas has raised $260m in Series F funding, reaching a valuation of $4.8bn.