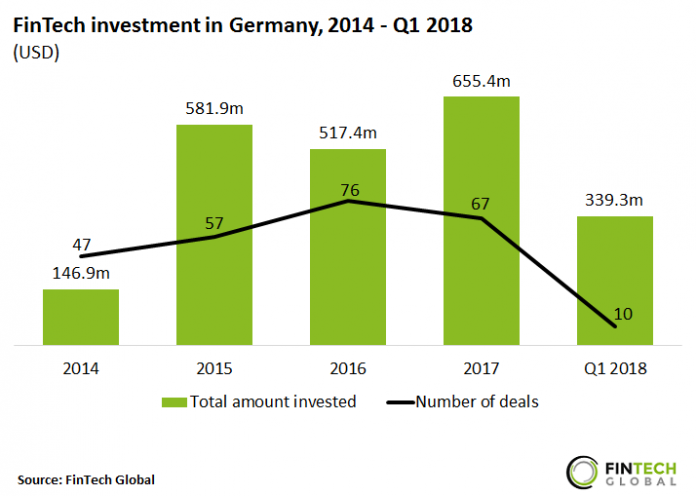

FinTech investment in Germany reached record levels in 2017 with over $650m invested

More than $2.2bn has been invested in German FinTech companies since 2014, with $655.4m raised across 67 deals last year.

Deal activity peaked at 76 transactions in 2016, with over $500m raised that year. N26, a Berlin-based mobile bank, raised $40m Series B funding in Q2 2016. This funding, led by Horizon Ventures, was the largest FinTech deal in Germany in 2016 and has allowed the company to roll out its product aggressively across Europe.

Almost 52% of the total capital raised by FinTech companies in Germany last year has already been raised in Q1 2018, setting strong funding expectations for the rest of the year.

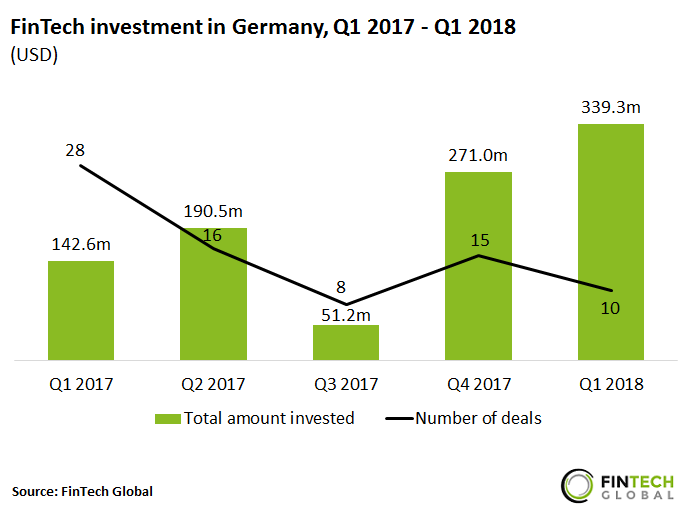

German FinTech companies raised almost $340m across 10 deals in Q1 2018

- More than 40% of the total investment in German FinTech companies last year was raised in Q4, with funding growing more than five-fold from the previous quarter.

- As a result, the average FinTech deal size in Germany grew from $5.1m in Q1 2017 to $18.1m in Q4 2017, as investors made an increased number of late-stage transactions.

- The bulk of capital raised in the last quarter of 2017 came from Polkadot, a Berlin-based Blockchain start-up, which raised $140m in an ICO to fund its plans to link public and private blockchains.

- SolarisBank AG, an API – accessible banking platform enabling businesses to offer financial services, raised $70m in Series B funding led by BBVA, to fuel international expansion. This funding round pushed average German FinTech deal sizes in Q1 2018 even further to just under $34m.

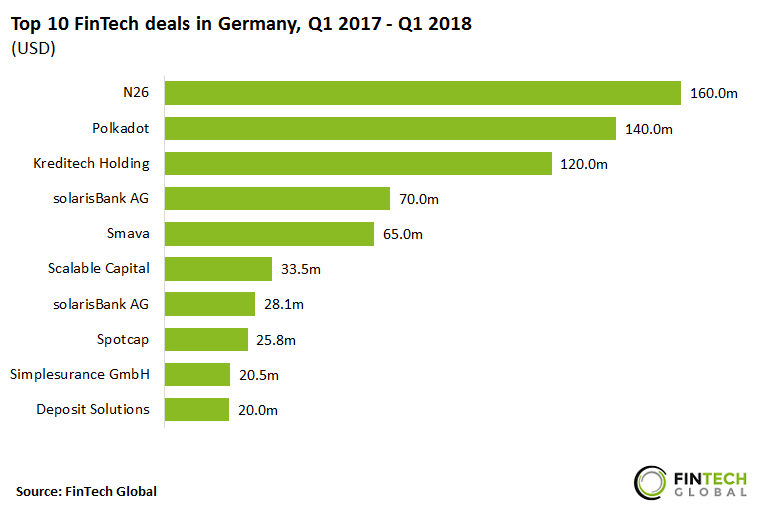

The top 10 FinTech deals in Germany over the past five quarters raised almost $700m

- The top 10 FinTech deals in Germany raised $682.9m over the last five quarters, with 43.2% of this raised by transactions completed in opening quarter of 2018.

- Three of the top 10 deals involved Marketplace Lending companies, with $210.8m invested in these transactions. Smava, a consumer loans platform, raised $65m in Series D funding, in the largest Marketplace Lending deal in Germany over the last five quarters. This investment, led by Vitruvian Partners, will be used to further accelerate product innovation.

- N26 raised $160m in Series C funding from Allianz X and Tencent Holdings in Q1 2018. This was the largest FinTech deal in Germany last quarter and the company plans to use the funding to accelerate international expansion, with a focus on the US and UK.

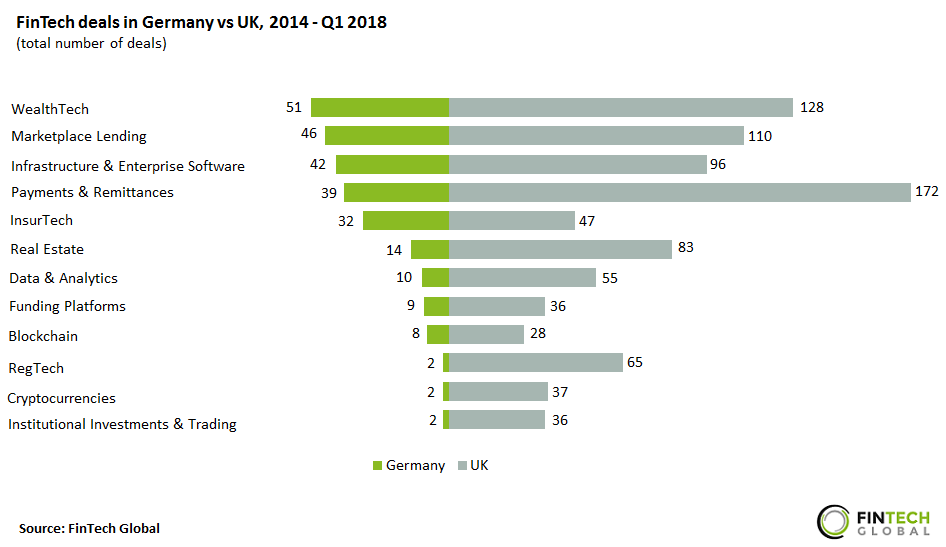

There have been almost four times as many FinTech deals completed in the UK than in Germany since 2014

- There have been 893 FinTech deals completed in the UK since 2014 compared to 257 in Germany, with the Payments & Remittances subsector attracting the bulk of transactions in the UK. The German FinTech ecosystem however has gained significant momentum and has the potential to recover ground quickly depending on the final outcome of the Brexit negotiations.

- In contrast to the UK, the FinTech ecosystem in Germany is diverse, with deal activity across the top four subsectors evenly distributed. WealthTech companies had a slight edge over over other subsectors attracting 51 deals with the previously mentioned N26 $160m funding round being the largest WealthTech investment in Germany to date.

- Marketplace Lending companies have been involved in 17.9% of FinTech deals in Germany as companies look to disrupt the traditional loan origination model deployed by banks. Kreditech Holding, a Hamburg-based consumer lending platform for the underbanked, raised $200m in debt finance in Q1 2015. This is the largest deal in this subsector in Germany so far.

- Infrastructure & Enterprise Software companies were not too far behind, attracting 16.4% of FinTech deals in Germany between 2014 and Q1 2018. The $70m Series B funding that previously mentioned SolarisBank AG raised in Q1 2018 is the largest transaction in this subsector to date, with the company raising a total of $111.7m since Q1 2016.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies in Germany and the UK as well as across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global