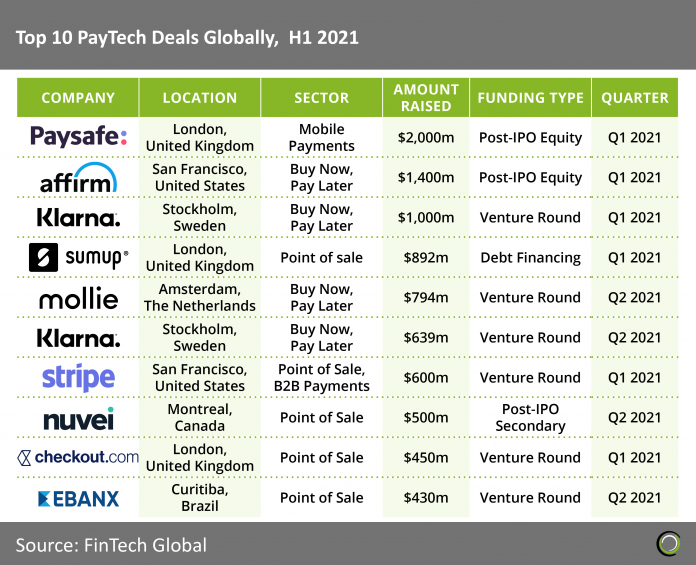

Buy-now-pay-later boom contributes to growth as companies in the area raise four out of the ten largest deals in H1

- Out of the top ten largest deals in H1 2021, five companies provide online point of sale systems, four operate in the buy now, pay later space, and one is a provider of mobile payments. All of these sectors have increased from the pandemic and the fast economic recovery in some ways. Online POS providers benefitted from the e-commerce boom due to closures of traditional stores in 2020, and also from the increase in consumer spending as economies recovered. Buy now, pay later firms experienced a similar boost from growth in the e-commerce sector. Many consumer habits and technological advances that the pandemic created are likely to persist indefinitely, meaning that it is sensible for investors to gravitate towards companies that benefit from these trends.

- The largest deal so far in 2021 was raised by UK based mobile payment provider Paysafe. Paysafe offers several different services to consumers and businesses, including a digital wallet, an online payment and money transfer service, and a prepaid card service named Paysafecard. Paysafe raised $2bn through a Post-IPO equity round in March 2021. This round involved eight different institutional investors, including the Fidelity National Title Insurance company and Third Point. Paysafe used some of this funding to acquire PagoEfectivo, a Peruvian company that facilitates online payments and allows merchants to offer alternative payment methods for an undisclosed amount in August of 2021. PagoEfectivo is a market leader in Latin America, and the transaction should allow the combined entity to continue to gain market share in Latin America.

- Another noteworthy company on the list is San Francisco’s Stripe. Stripe provides a payment processing platform for online businesses, allowing businesses to send and receive payments over the internet. In March 2021, Stripe raised $600m from 7 investors, which included venture capital titan Sequioa Capital. This Series H round placed Stripe’s valuation at $95bn. Stripe stated that they would use this funding to expand their operations in Europe due to surging demand from businesses in Europe. Additionally, Stripe will also use the capital to expand its global payment network. In July 2021, Reuters reported that Stripe has undertaken the first steps towards going public. Should the company proceed with these plans, it would be one of the most eagerly anticipated IPOs of the decade.

- Ranked sixth on this list and raising a total of $2.6 Billion is Affirm. Affirm provides online instalment loans for the customers of e-commerce businesses, allowing shoppers to pay their purchases in installments. Affirm promises customers that payment plans are free of surprising late fees or compounding interest rates, which makes it a customer friendly option compared to credit cards that compound interests or other online lenders that profit from late fees. In the current ultra-low interest rate environment, and with consumers in developed markets being more willing to go into debt to make certain purchases, Affirm’s business model is very in demand. Affirm is also a public company, having listed on the NASDAQ in January 2021. Affirm raised $1.4bn in post-IPO equity from investors SV Angel and GGV Capital in January of 2021. The company has used some of this funding for M&A activity, including the acquisition of Returnly, a company that streamlines the returns and post-purchase payment processes for e-commerce businesses.

- Another company implementing the “buy now, pay later” business model is Klarna. Based in Stockholm, Klarna raised over $1.6bn in 2021, making it an important recipient of funding. While Affirm operates mainly in North America, Klarna offers its payment solutions to customers in Europe. The entire “buy now, pay later” experienced an uplift recently after US Fintech giant Square announced the acquisition of AfterPay on 1 August.

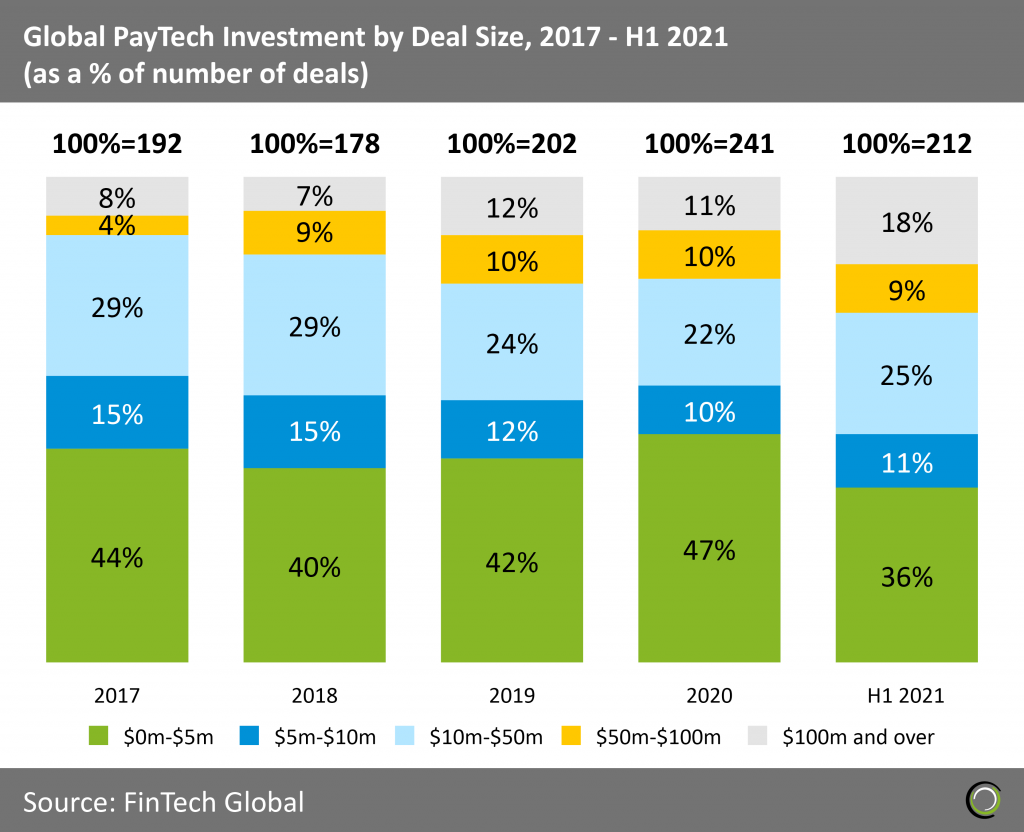

PayTech investment trends towards mid to large size deals as pandemic accelerated adoption of PayTech

The PayTech sector has a significant amount of deals larger than $10m in size with around half the deals in each year being $10m in size or larger. In H1 2021, 52% of deals were larger than $10m, up from 43% in 2020 and 48% in 2019. This trend reinforces the assertion that the PayTech sector is one of the most mature FinTech sectors, with many companies in this space being large and established. H1 2021 was especially notable for having 18% of deals being larger in size than $100m, suggesting that institutional investors are confident investing large amounts into mature PayTechs.

The PayTech sector has a significant amount of deals larger than $10m in size with around half the deals in each year being $10m in size or larger. In H1 2021, 52% of deals were larger than $10m, up from 43% in 2020 and 48% in 2019. This trend reinforces the assertion that the PayTech sector is one of the most mature FinTech sectors, with many companies in this space being large and established. H1 2021 was especially notable for having 18% of deals being larger in size than $100m, suggesting that institutional investors are confident investing large amounts into mature PayTechs.- In many ways, the pandemic has accelerated global use of technology and use of PayTech products. Hygiene risks of cash transactions have motivated consumers to go cashless, benefitting mobile payment apps. Trans-border payment services have benefitted from a lack of business travel and widespread adoption of remote work. Increased use of e-commerce by consumers have benefitted e-commerce PayTechs and online payment processing firms. Buy now, pay later companies and online lenders have benefitted from consumers budgetary constraints. This makes the PayTech sector as a whole attractive to investors who seek durable growth companies and a hedge against other risks associated with the current or future pandemics.

- While the share of the largest deals has increased significantly in H1 2021, the amount of deals under $5m in size decreased compared to previous years. This shows that investment in the PayTech sector trends towards companies that are large, established, and mature. When looking at the companies that raised the largest deals in 2021, several were founded in the mid 2000s or earlier, hence, they have established themselves and now need larger amounts of funding to continue to grow. Additionally, with the PayTech sector trending towards established players, backing new entrants can be a risky investment as they are more likely to fail in a crowded market and with insufficient scales. This makes well-established growth companies a more attractive preposition than startups for more risk-adverse investors.

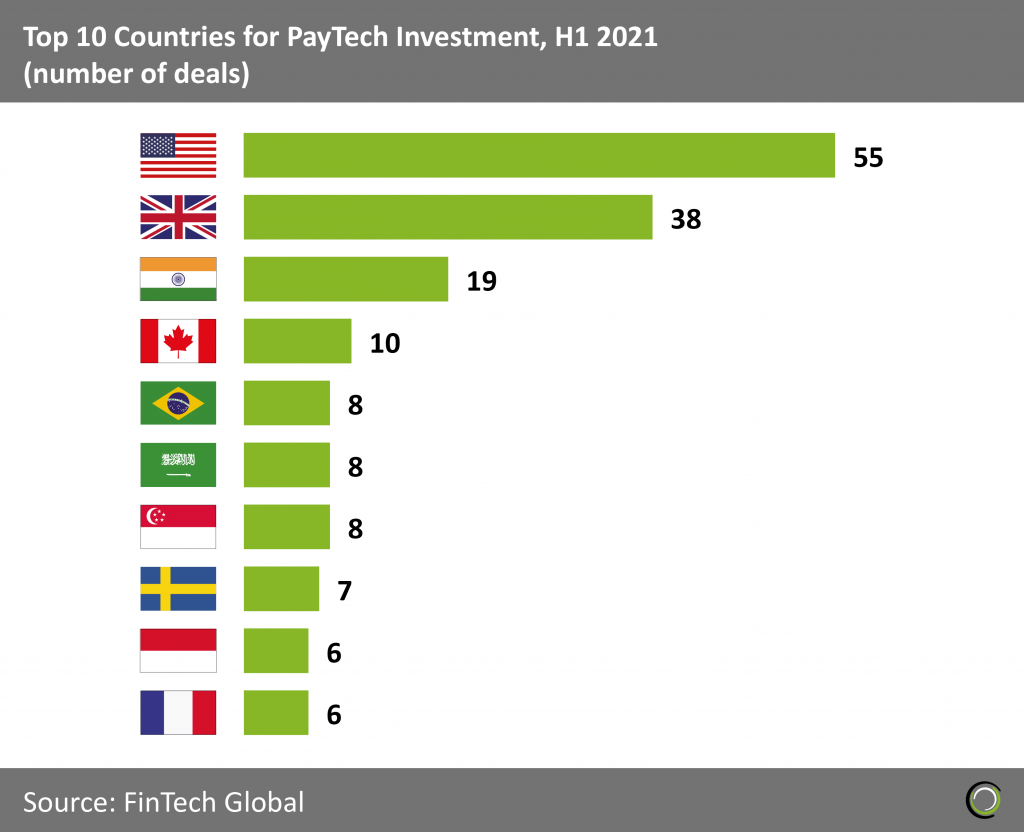

United States leads global PayTech sector by number of deals in H1, followed by the UK

With 55 deals in H1 2021, the United States leads global PayTech investment in terms of total number of deals. The United States is an attractive location for PayTech companies thanks to the presence of a developed home market, synergies with the well-established banking sector, low corporate tax rates, and because of a cultural incline towards innovative start-ups, especially in the San Francisco Bay Area.

With 55 deals in H1 2021, the United States leads global PayTech investment in terms of total number of deals. The United States is an attractive location for PayTech companies thanks to the presence of a developed home market, synergies with the well-established banking sector, low corporate tax rates, and because of a cultural incline towards innovative start-ups, especially in the San Francisco Bay Area.- The United Kingdom follows behind with a total of 38 deals. The United Kingdom is known as the premier European country for FinTech in general, and the amount of PayTech investment compared to other countries confirms this trend. Much like the United States, the UK has a well-developed banking sector that creates synergies for the PayTech industry. Consumers in the UK also tend to be very technologically competent, which creates a larger home market as technologically inclined consumers will be more likely to trust new electronic payment services.

- India is a significant developing market for PayTech. While a total of 19 deals might not seem significant when accounting for India’s population of 1.4 Billion, India can be a sizeable market for PayTech going forward. The World Bank estimates that around 191 million people in India are unbanked, making it the second largest unbanked population in the world behind China. As an ever-growing share of the population gains access to smartphones and the internet, PayTech solutions will be crucial in delivering banking and payment services to this population, creating a large, untapped market. Additionally, India’s growing middle class will create a sizeable market for e-commerce businesses like Flipkart going forward.

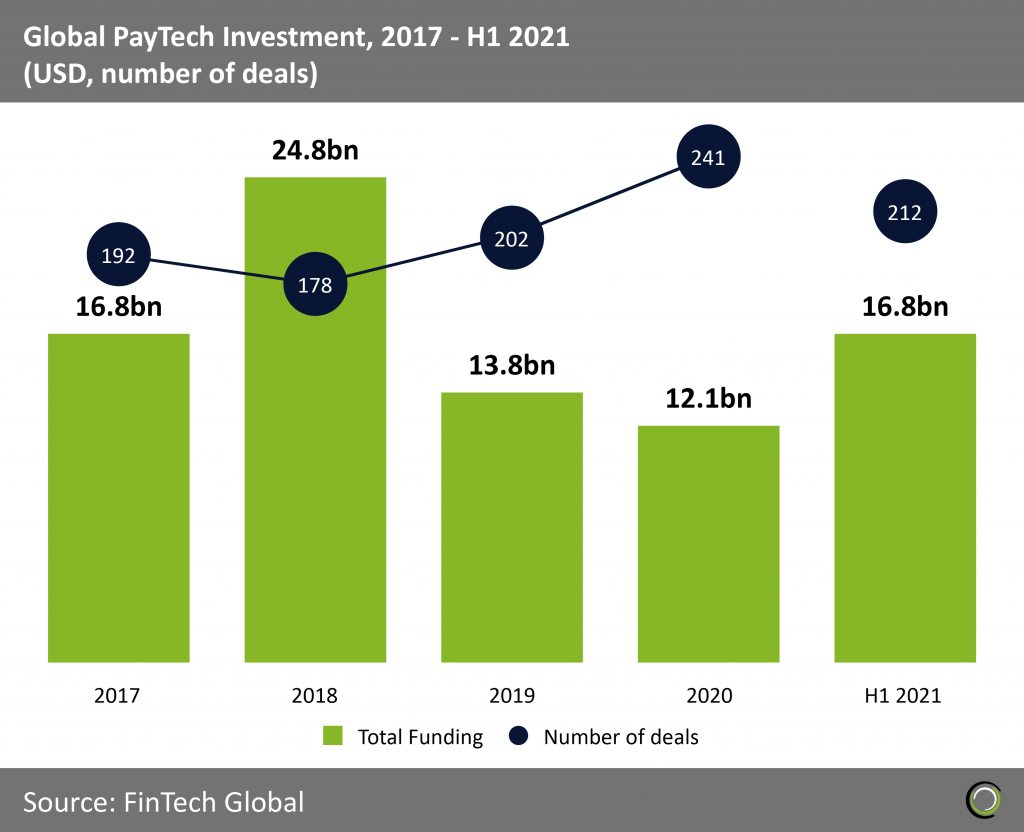

Global PayTech investment trends upwards after slumping in 2020

- Total investment in the PayTech space is already considerably higher in the first half of 2021 than for all of 2020. In the first six months of the year, PayTechs raised $16.8bn across 212 deals, compared to $12.1bn over 241 deals in 2020. This shows that the unprecedented economic rebound in the second half of 2020 reinstated investor confidence. Should this level of funding continue throughout the rest of the year, 2021 will be on track for becoming the year with most PayTech deal activity since 2018

- While 2018 represents a five-year high in terms of total PayTech funding on this chart, it is worth noting that Ant Financial’s $14bn funding round in 2018 skews this data towards the upside. When looking at the total number of deals, PayTech deal activity was down slightly in 2018 compared to the previous year, with 178 deals in 2018 compared to 192 in the previous year. If one were to remove this round from the data, 2018 would also have less investment by total dollar amount when compared to the previous year.

- Looking past 2021, the uptrend in the PayTech industry should be expected to continue. Many countries are recovering quickly from the COVID 19 pandemic, and increased consumer spending could make e-commerce, point of sale, or mobile payment PayTechs attractive investments. Additionally, large unbanked populations continue to exist in the developing world, creating large, untapped markets for PayTechs that service consumers and businesses in these regions.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

The PayTech sector has a significant amount of deals larger than $10m in size with around half the deals in each year being $10m in size or larger. In H1 2021, 52% of deals were larger than $10m, up from 43% in 2020 and 48% in 2019. This trend reinforces the assertion that the PayTech sector is one of the most mature FinTech sectors, with many companies in this space being large and established. H1 2021 was especially notable for having 18% of deals being larger in size than $100m, suggesting that institutional investors are confident investing large amounts into mature PayTechs.

The PayTech sector has a significant amount of deals larger than $10m in size with around half the deals in each year being $10m in size or larger. In H1 2021, 52% of deals were larger than $10m, up from 43% in 2020 and 48% in 2019. This trend reinforces the assertion that the PayTech sector is one of the most mature FinTech sectors, with many companies in this space being large and established. H1 2021 was especially notable for having 18% of deals being larger in size than $100m, suggesting that institutional investors are confident investing large amounts into mature PayTechs. With 55 deals in H1 2021, the United States leads global PayTech investment in terms of total number of deals. The United States is an attractive location for PayTech companies thanks to the presence of a developed home market, synergies with the well-established banking sector, low corporate tax rates, and because of a cultural incline towards innovative start-ups, especially in the San Francisco Bay Area.

With 55 deals in H1 2021, the United States leads global PayTech investment in terms of total number of deals. The United States is an attractive location for PayTech companies thanks to the presence of a developed home market, synergies with the well-established banking sector, low corporate tax rates, and because of a cultural incline towards innovative start-ups, especially in the San Francisco Bay Area.