Sanction Scanner conducted a comprehensive survey, gathering insights from over 400 respondents across more than 50 countries and various industries. The findings shed light on the current state of Anti-Money Laundering (AML) knowledge and practices.

In terms of familiarity with AML regulations, a significant portion of respondents described themselves as “somewhat familiar” with the latest AML and financial crime regulations for 2023. This suggests that while basic understanding exists, there is room for deeper knowledge and awareness.

The impact of recent legal changes was notable, with many respondents reporting confusion and the need for adjustments in their industry’s approach to AML and financial crime prevention. This underscores the necessity for organizations to remain agile and adaptable in response to evolving regulations.

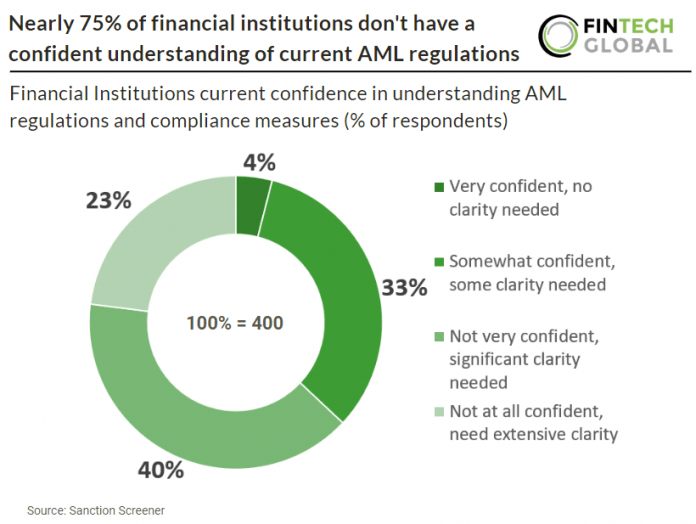

A concerning trend emerged regarding confidence in understanding AML regulations, as a significant portion of respondents expressed “not very confident” in their comprehension of current AML regulations. This indicates a need for enhanced training and educational initiatives within organizations.

Reporting challenges were identified as the most commonly cited obstacle faced by organizations, including complexity in data management and reporting processes, limited compliance resources, and difficulties in interpreting regulatory guidelines. These findings stress the importance of investing in resources and training to improve compliance capabilities and implementing streamlined reporting systems.

Another notable finding was the uncertainty among respondents regarding whether their industries had unique AML and financial crime requirements, highlighting a potential knowledge gap. Tailoring AML requirements to specific institutional circumstances is crucial in addressing this gap.

In terms of threat perception, respondents identified the e-commerce industry as facing higher levels of threats related to fraud and financial crime, while the banking and finance sector was seen as more vulnerable. Understanding these perceptions can guide industries in tailoring their preventive measures accordingly.