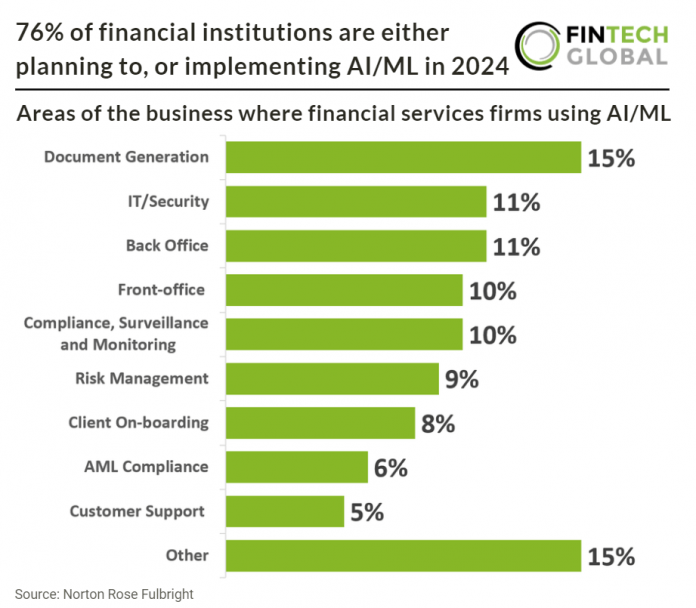

A survey conducted by Norton Rose Fulbright across global financial services firms indicates that 76% of respondents are either currently using AI/ML or considering its implementation. The majority of firms are either in the initial stages of AI/ML development or contemplating its limited use. Furthermore, 94% of financial services firms anticipate increased utilization of AI/ML in the next three years.

While there are evident benefits to using AI/ML, including efficiency gains, cost savings, and improved services, there are also challenges and considerations. These include potential risks such as corporate data leakage, regulatory compliance, and the need for clear usage policies and staff training. Data limitations, regulatory barriers, and insufficient expertise are identified as key obstacles to AI/ML adoption. However, most firms recognize the necessity of engaging with regulators and complying with existing regulations.

In terms of AI/ML model development, financial services firms predominantly rely on in-house resources, either exclusively or supplemented with third-party assistance. The effectiveness of ML models is heavily dependent on access to adequate training data, which can be a challenge to source. Consequently, data limitations are seen as a significant barrier to adoption.

76% of financial institutions are either envisaging, or using AI/ML in 2024

Investors

The following investor(s) were tagged in this article.