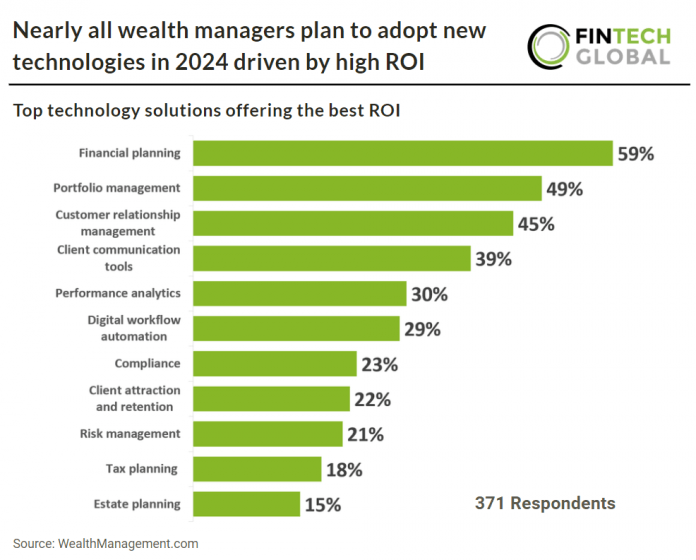

WealthManagement.com’s survey included 371 respondents from advisors, c-suite executives and others across RIAs, Insurance firms, Regional investment firms, Wirehouse firms and Bank brokerages from around the world.

When it comes to delivering value, certain technology solutions stand out for their return on investment (ROI). Over time, financial planning, portfolio management, customer relationship management (CRM), and client communication tools have consistently been perceived as delivering the best ROI. While overall satisfaction with the ROI from current technology stacks has remained steady, with roughly a third of respondents expressing being “very satisfied” and most being “somewhat satisfied,” satisfaction levels vary significantly across advisor categories.

A vast majority of respondents (91%) express intentions to embrace new technology in 2024, with a primary focus on solutions aimed at enhancing client attraction and retention, as noted by 36% of participants. Following closely, cybersecurity emerges as the second most popular consideration, cited by 32% of respondents, a choice introduced in 2023.

Additionally, digital workflow automation (32%), portfolio management (31%), performance analytics (28%), and client communication tools (26%) are among the leading solutions being contemplated. Notably, compliance (21%), financial planning (21%), and risk management (18%) also make the list. Analysis reveals that among Innovators and Operators, the top four solutions anticipated for adoption align with the overall findings. Furthermore, there is little disparity across firm types concerning the portion of firm revenue earmarked for technology expenditure in 2023.