Tag: Anti-Money Laundering

Napier AI connects FinTech innovation with anti-money laundering strategies in new...

In the latest episode of Napier AI's podcast series, Paysafe’s former MLRO and Napier AI's data scientist delve into the integration of machine learning (ML) in combating financial crimes within the FinTech sector.

Essential guide to Anti-Money Laundering (AML) compliance in 2024

FullCircl, a SaaS platform renowned for eliminating regulatory and verification hurdles, has offered a complete guide to money laundering regulations 2024. The updated guide explores the current global Anti-Money Laundering (AML) regulations, providing essential insights for staying compliant.

The UK accounts for more than a third of European FinTech...

Key European FinTech investment stats in Q1 2024:

• European FinTech deal activity totalled at 333 deals in Q1 2024, a 41% reduction from the...

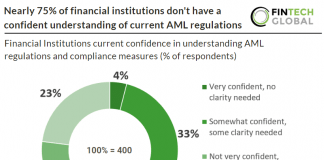

Nearly 75% of financial institutions don’t have a confident understanding of...

Sanction Scanner conducted a comprehensive survey, gathering insights from over 400 respondents across more than 50 countries and various industries. The findings shed light...

Navigating KYB checks: The gateway to business transparency and trust

In today's digital era, where business transactions and partnerships extend beyond borders, the importance of conducting due diligence cannot be overstated.

European InsurTech companies raise over $10bn since 2019

Key European InsurTech investment stats in 2023:

• European InsurTech deal activity totalled at 126 deals in 2023, a 44% reduction from the previous year

•...

AMLA’s new home in Frankfurt: Strengthening EU’s fight against financial crime

In a significant announcement made in February, the Council of the European Union revealed that Frankfurt has won the competitive bid to host the Anti-Money Laundering Authority (AMLA), marking a pivotal moment for regulatory oversight within the EU.

AI emerges as the top threat for UK’s regulated firms in...

In the UK, the deployment of artificial intelligence (AI) is perceived as the principal threat for over half of the regulated firms this year.

A...

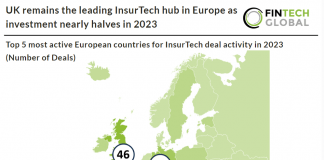

UK remains the leading InsurTech hub in Europe as investment nearly...

Key European InsurTech investment stats in 2023:

• European InsurTech deal activity totalled at 126 deals in 2023, a 44% reduction from the previous year

•...

Hawk AI welcomes new general manager Robin Lee

Hawk AI, a front-runner in AI-driven solutions for fraud and anti-money laundering (AML) surveillance, has recently announced the strategic appointment of Robin Lee as General Manager for the Asia-Pacific (APAC) region.